Price Commentary

After last month saw some stabilization in certain product categories – namely CBD Flower, THC Free CBD Distillate, and various types of seeds and clones – significant price declines were observed across the board in April. Based on reports from the field, overall trading volumes of CBD Biomass contracted this month as prices for such plant material deteriorated further. A processor in North Carolina stated to our analysts that many farmers he spoke with still had large amounts of plant material on hand and were attempting to move it for whatever price they could get. With this year’s harvest approaching in about five months, some growers will ultimately take losses on last year’s crop.

Trading volumes for seeds and clones were generally up, as farmers looked to secure stock to propagate this year’s crops. However, prices for seeds and clones of all kinds declined by at least 6%, indicating that supply is plentiful. Notably, the steepest price decreases in this category were for CBD Seeds, both Feminized and, especially, Non-Feminized. Some farmers are scaling back their cultivation capacity this year, reducing demand for seed stock. Some growers also secured seeds or clones for this season prior to April.

Extracted forms of CBD saw continued price erosion in April as well. Just as in prior months, however, THC Free Distillate retained value better than its counterparts. Reports from our Price Contributor Network indicated that trading volumes of THC Free and Full Spectrum Distillate remained robust. Significant inventories of extracted CBD remain unsold, even as some processors shifted their production lines this month to making hand sanitizer in response to the COVID-19 pandemic.

Similar to last month, prices for CBG products decreased significantly, particularly those for CBG Biomass and CBG Isolate. As we pointed out in our March report, higher prices for CBG Biomass and extracts last year were enticing to many farmers and processors, but questions remain as to whether there is significant demand for CBG from consumers.

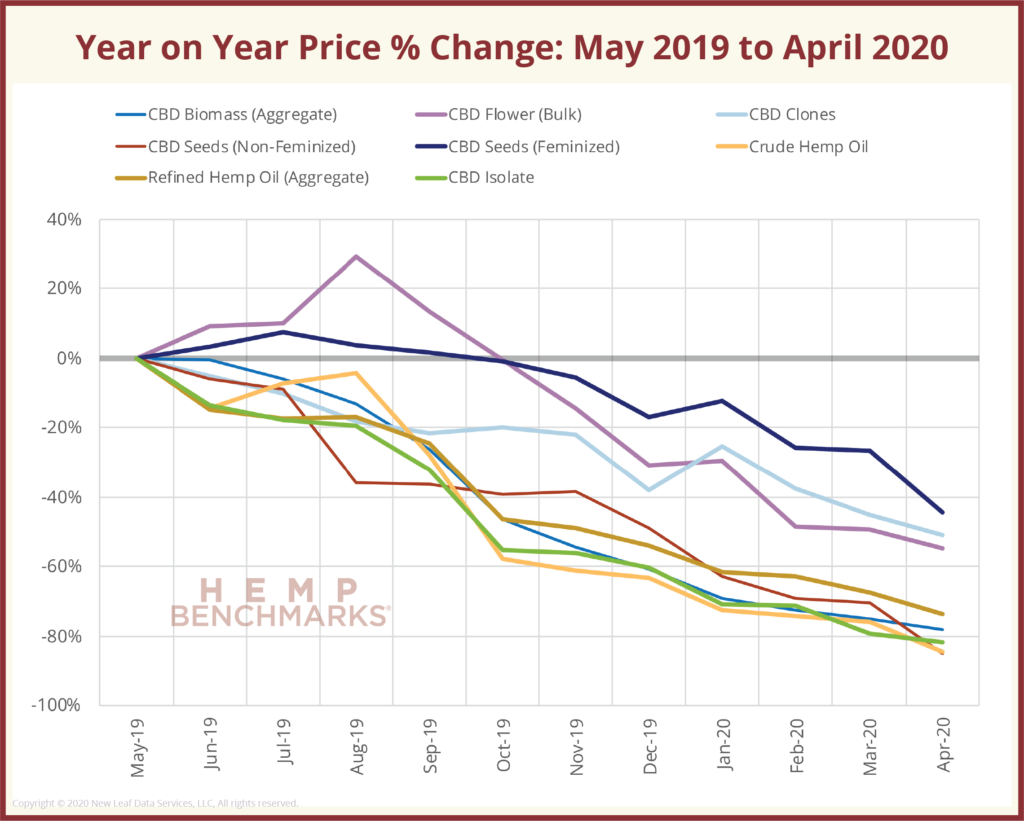

This chart illustrates the dramatic erosion in wholesale prices in the U.S. hemp market over the past year. It also reinforces the data in our product Correlation Matrix which has consistently shown that price movement in the hemp-CBD supply chain is strongly correlated. The major exception is the price for smokable CBD Flower, which rose through last summer as demand manifested amongst consumers. However, with plentiful supply in the wake of the harvest, rates for high-CBD Flower have plunged after peaking in August 2019.

April 2020 Hemp Spot Price Index Report Headlines

Price Commentary

Larger price declines observed in April after some stabilization in March; Crude CBD Oil and CBG Isolate both off 36% from last month; Biomass trading volumes down.

COVID-19 Impacts

Hemp cultivation and CBD processing declared essential in most cases, but sales slow.

Projections for the 2020 Growing Season

States with mature programs report applications to grow are slowing relative to 2019.

Fallout in the Cannabinoid Extraction Sector

Heat map details US extraction capacity, but COVID and general market challenges likely to reshape the landscape this year.

Federal Regulatory Update

Hemp businesses eligible for relief programs, but survey responses indicate pessimism regarding government aid.

Industry Developments

New industrial and agricultural applications for hemp are being pursued.

State Updates

CO provides update on exports of hemp seed; VA legalizes CBD for use in food.

We Want to Hear From you!

This week we launched our Hemp Extraction & Processing Survey. This survey aims to further identify the full extent of hemp extraction and processing capacity in the United States. If you’re involved in the processing of hemp to crude oil, distillates, or isolate, please take 3 minutes to complete a short survey and help us better inform you.