Price Commentary

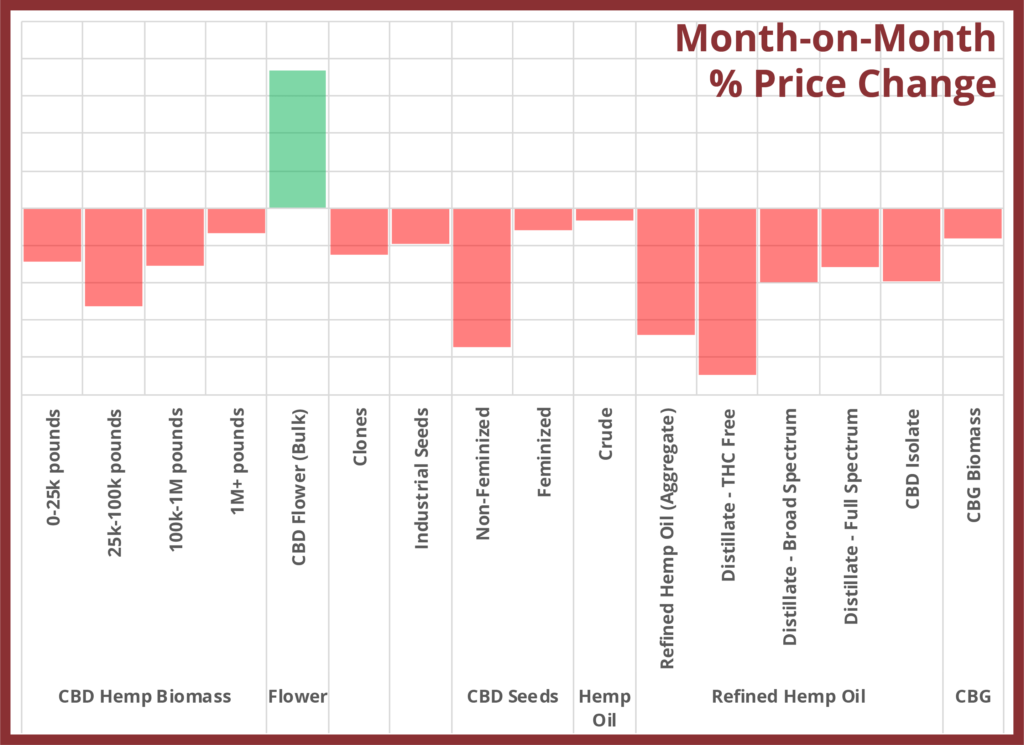

With reports that the 2020 harvest is beginning in earnest this month, there is significant uncertainty amongst market participants as to how farm gate prices for hemp plant material will respond to the influx of new production. With 2020’s crops not yet dried and processed for sale for the most part, this month’s assessed prices for last year’s CBD and CBG Biomass were down from July. However, based on our observations from over five years covering legal cannabis markets, wholesale prices can increase with the arrival of a new fall crop, as fresh plant material can garner better rates than that which is nearly a year old.

We pointed out in last month’s report that registered acreage for 2020 is down about 30% year-over-year. Early reports from state officials suggest a smaller percentage may have been planted this year compared to 2019, when only about half of registered acreage was farmed.”

Reports from the field indicate growing conditions were mixed across the U.S. Oregon, one of the country’s biggest hemp-producing states, appears set to see a bumper crop if conditions hold. Elsewhere, farmers reported that high heat and drought have led to plants flowering prematurely, leading to earlier harvests and lower yields. Persistently dry conditions in many parts of the country should help producers better preserve biomass and flower from mold that rendered unsaleable a significant portion of last year’s crop. Overall, though, Hemp Benchmarks still expects that 2020’s production of CBD and other cannabinoid-rich biomass will be down from last year, possibly significantly so.

As prices for most hemp products covered by our reporting declined in August, one area of notable increase was the rate for smokable Bulk CBD Flower. Additionally, Hemp Benchmarks this month began to collect price data on smokable CBD flower by grow type: indoor, greenhouse, and outdoor. We do not yet have enough data points to justify publishing official assessments, but early observations show prices for indoor-grown flower are elevated compared to those for greenhouse product, with the former sometimes going for as much as double the latter, while outdoor-grown flower generally fetches the lowest rates.

It is important to note that the outdoor flower being traded currently was harvested last year, which is likely contributing to lower prices. Indoor and greenhouse operations generate multiple crops annually, so on-hand flower is typically fresher, with better appearance and aroma. Seed and clone sellers have reported an uptick in the amount of growers using their stock for indoor and greenhouse operations with multiple annual harvests. The increased prevalence of higher-priced indoor and greenhouse-grown smokable flower helped push overall rates for such product upward.

Prices for all forms of extracted CBD and CBG saw significant deterioration this month. Among this group the significant drop in the price of THC Free CBD Distillate is especially notable, as such product had previously been observed to retain value better than other CBD extracts. Reports from market participants have indicated that processors have been increasingly focusing on THC remediation of Crude and THC-containing Distillates, rather than processing biomass, which may have contributed to the downturn in THC Free prices.

With rates for CBD and CBG extracts sliding, another new development observed in our price data this month was transactions involving delta-8 THC products. Delta-8 THC is not derived from hemp plant material, but synthesized from extracted CBD. Our Price Contributor Network provided nearly two dozen transactions for delta-8 THC Distillate this month, with prices ranging from $1,800 to $3,500 per kilogram. Observed asking prices on exchanges and marketplaces exceeded the average confirmed transaction prices by several thousand dollars.

Additionally, some sellers are infusing smokable hemp flower with delta-8 THC distillate. Such product is being hawked at high asking prices, though again we will publish official assessments once sufficient data is able to be collected. We discuss delta-8 THC more in this month’s report, including its contested legal status. For more news, price assessment details, and analysis, subscribe to the monthly Hemp Spot Index Report.

August Report Contents

Growing Season Update

Harvest begins. Reports from farmers and agronomists across the country on crop health.

Weather Outlook

Favorable growing conditions in Pacific Northwest. Heat and drought impacting the West and Grain Belt. Hurricanes saturating fields in the South and Atlantic coast.

Oversupply and Continued Price Concerns

As this year’s crop begins to be harvested, what impact will the remaining 2019 crop have on pricing?

COVID-19 Latest

USPS delays impacting CBD product deliveries

Hemp Transportation Costs Update

Shipping prices remain high with demand far outstripping truck availability.

Producer Survey Results

Several hundred hemp producers responded to our 2020 Hemp Production Survey. We analyze the results and provide key findings.

Federal Regulatory Updates

Challenges with USDA IFR continue as states begin rejecting the current state of the rules. Major concerns raised over DEA announcements and how the IFR could impact the industry.

Industry Developments

Smokable hemp legalization is challenged in several states. New storage options emerging for hemp biomass.

Research

Advances in hemp breeding. Research to identify most suitable hemp cultivars for different growing regions receives funding and support from several major universities.

State Updates

Latest news on status of hemp operations and legislation in Arizona, Georgia, South Dakota and Texas.

International Updates

CBD status in the European Union continues to place industry in jeopardy. Hemp production in Poland continues to expand as cultivation efficiencies lower costs for farmers.