While much of the world’s paper and paper products are currently made from wood (as well as recycled paper), there is a growing demand for the greater use of hemp-based paper as an environmentally-friendly and economically viable alternative.

A Global Industry with Major Sustainability Implications

Paper made from hemp has been produced for millennia, and was widely used in many countries. Starting in the 1800s, however, rediscovered papermaking techniques that employed ground-down tree fibers, combined with a bleaching and softening process for wood pulp, led to the birth of the modern wood paper industry. Since that time, wood pulp and paper manufacturing has evolved into one of the world’s largest industrial sectors, with a global market value of nearly $350 billion in 2020, according to the research firm Statista.

Given its size, the wood paper and pulp industry has a huge influence on the planet’s forests and overall environment. According to the World Wildlife Fund (WWF), wood pulp and paper production accounts for up to 40% of all industrial wood used globally. While technically a sustainable resource, WWF noted that wood pulp and paper manufacturing is energy-intensive, consumes vast amounts of water, and often creates toxic pollutants as manufacturing by-products. It also contributes to deforestation.

A Shift Away from Wood Pulp

Hemp industry stakeholders and advocates, meanwhile, say hemp paper is a renewable resource with a much smaller environmental impact than its wood counterpart. Western States Hemp, which describes itself as Nevada’s largest hemp grower, notes on its website that an acre of hemp grows to full maturity in three to four months, and can produce as much paper as four acres of trees, while trees can take years, if not decades, before they can be harvested for paper.

Ed Lehrburger – President and CEO of PureHemp Technology in Colorado, a company that has been researching and developing hemp products for the past eight years – said that while hemp paper has yet to be developed for large-volume production, there is a growing interest by both consumers and corporate America in developing a viable hemp paper industry. “More and more people in companies want to shift away from wood pulp,” he noted, “due to the sustainability advantages of non-wood pulp. In addition, more people are becoming hemp-inspired, although many are not willing to pay any more for hemp paper products.”

Lokendra Pal is an associate professor with the Department of Forest Biomaterials, College of Natural Resources, at North Carolina State University. He told Hemp Benchmarks that, while the development of hemp paper for mass production is still in its infancy, he believes it could end up playing “a very big role” in future paper manufacturing due to the growing demand for sustainability and economic efficiency.

Relearning Hemp Paper Manufacturing Technologies

As in other hemp product manufacturing verticals, previously-developed techniques and technologies faded away when hemp was outlawed in the U.S. nearly a century ago. Now, stakeholders in the hemp paper industry are having to relearn a lot of the processes needed to create the best hemp paper products possible.

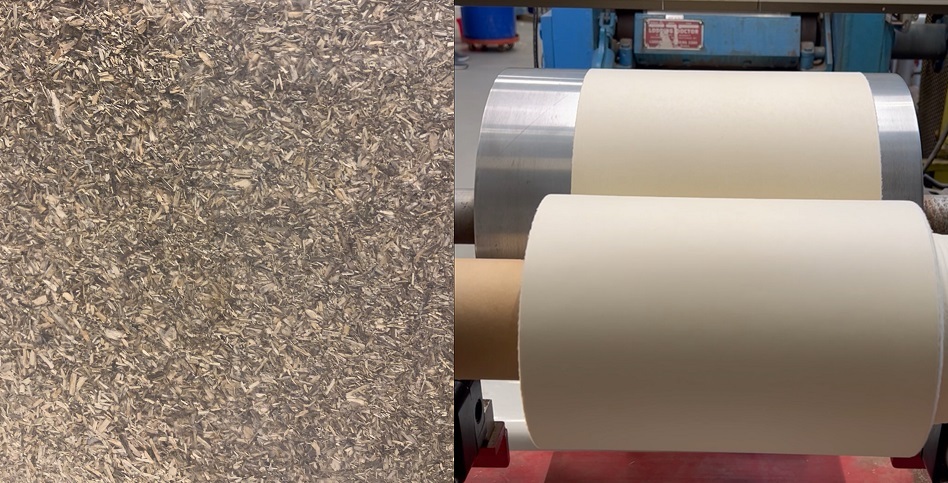

“We never got the recipes from yesteryear, and so we‘ve been doing trial and error,” said Ed Lehrburger. He told Hemp Benchmarks his firm has its own decortication facility and is developing new processes to use hemp hurd, the woody inner section of the hemp stalk. While hemp hurd makes up about 70% of the usable fibers found in industrial hemp, it has been considered best used for construction, animal bedding, and plastic products. In contrast, the plant’s outer bast fibers have been recognized for their uses in textiles and other industries.

When it comes to the development of hemp paper, Lehrburger said, “we’ve been learning that the ratio of hurd and bast fibers makes a significant difference in manufacturing quality pulp for paper products. We also know that some entities are only using bast fiber to make pulp and paper, and we’re trying to integrate hurd into the pulp source.”

PureHemp Technology is currently supplying hemp pulp, which is blended with recycled wood paper and pulp, for some paper companies. Lehrburger has also developed proprietary technologies for converting hemp into pulp and paper. During July, he said, PureHemp Technology will be involved with a trial production run of 100%, unbleached paper, using about 20,000 pounds of hemp pulp, at a paper mill on the East Coast.

Small Businesses Paving the Way

Hemp Benchmarks approached several of America’s major paper companies for their thoughts on the future of hemp-based paper. Those requests for comment, however, were either declined or went unanswered. While sources interviewed by Hemp Benchmarks said that major paper producers have shown interest in hemp, it appears that, as in other industries, the large corporations are waiting on the sidelines as small, independent companies perform innovative research and development.

Along with PureHemp Technology and others, Oregon-based Hemp Press is a company that produces hemp paper and paper products. Hemp Press advertises its products as being manufactured with half of the fibers “sustainably sourced from organic hemp fields,” and the remaining fibers coming from recycled post-consumer content. According to the company, choosing hemp paper, when compared with traditional wood pulp paper, results in 45% less energy used, 38% less greenhouse gasses produced, 45% less wastewater generated, and 50% less solid waste created.

“Growing and harvesting hemp is less resource intensive and ecologically destructive than timber and hemp fiber pulping requires less chemistry and produces less waste,” Matthew Glyer, Founder and CEO at Hemp Press, wrote in an email to Hemp Benchmarks. “More comparative analysis and research is under way now.” Glyer also noted that his company’s research is available for large-scale wood paper manufacturers, with some of those companies showing interest in Hemp Press’ technology.

As with many new technologies and products, pricing for hemp paper is usually higher than its mainstream, wood pulp counterpart. “The difference in price depends largely on the scope of the project and the value / features of the comparative product,” Glyer said. “Pending results of our ongoing research and product trials, as well as the growth of domestic hemp fiber farming, I do expect hemp paper to reach cost parity with wood papers within a matter of years.” He also expects “explosive growth” of the hemp paper industry over the next several years, with large-scale adoption of hemp paper and paper products by “leading” multinational companies.

Overcoming Unexpected Challenges to Create a “Circular Economy”

During his research on hemp paper production, Lehrburger of PureHemp Technology in Colorado said he has made some unexpected discoveries. For example, he noted, the difference between the types of hemp cultivars used can be significant. “We recently processed three cultivars,” he said, “and the one cultivar that was the fiber cultivar was the hardest for us to convert into good pulp. So there’s a lot of surprises and challenges.”

Another issue is how best to remove lignin, the polymer found in hemp hurd, to create a uniform hemp product. Lehrburger said that his company is working with a “strategic partner” on developing a new cultivar for hemp paper production. “It’s a confidential program,” he said, “but things are happening out there.”

Pal at North Carolina State University said his laboratory has created “a process that uses just water and high temperatures, a hydro-thermal process with no chemicals … to create a 100% sustainable fiber” for hemp paper. He also noted that hemp has natural, anti-microbial qualities that can have benefits for use in paper and paper products. “We have shown [that hemp] can replace 20%, 30% of the woody material used for hygiene products, napkins, even pizza boxes,” he added.

Pal also believes it is important for hemp paper to create a “circular economy” that promotes sustainability. “We are trying to [create value for] the 60% to 70% of the plant’s core material, the material that is being used for animal bedding, construction, or being left behind in the field,” he said.

Related Articles:

- How the Automotive Industry is Incorporating Hemp Fiber Products to Meet Sustainability Goals (June 8, 2022)

- Can Hemp Lumber Cut into the Wood Industry? (April 13, 2022)

- The Huge Potential of Hemp Plastic Compounds (January 12, 2022)