In March, two of the largest U.S. hemp-CBD companies – CV Sciences and Charlotte’s Web – released financial results for Q4 2019, completing information for the previous calendar year. The information included in the companies’ press releases raises the possibility that demand for CBD products may be cooling somewhat. Notably, however, e-commerce sales appear to be expanding, offering a potential pathway for continued growth even in the face of the COVID-19 pandemic.

To begin with CV Sciences, the company’s $53.7 million in sales in 2019 represents an increase of 11% compared to the year prior. The company’s products were stocked in over 5,500 stores in the U.S. as of the end of last year, a massive expansion compared to the over 2,200 shops that stocked CV Sciences products as of the end of 2018.

Despite the significant increase in the availability of CV Sciences products, the company recorded sales of $9.4 million in Q4 2019, down by 34% compared to $14.2 million in Q4 2018. According to the company, “Fourth quarter [2019] sales were impacted by increased market competition in the natural product category, and the continued impact on retail customers as a result of the uncertain regulatory environment for CBD.”

CV Sciences expects to generate between $6 million and $8 million in revenue in Q1 2020. The press release was issued on March 16, therefore the company would have been able to see a significant portion of Q1 2020 sales at the time the outlook for the current quarter was issued. No explanation for the expected decline was offered.

Charlotte’s Web also reported weakening sales at the end of 2019, with Q4 revenue increasing year-over-year to $23 million, but declining by 9% from Q3. Similar to CV Sciences, Charlotte’s Web attributed the Q4 downturn to two issues: “first, the negative Q4 FDA comments; and second, competitive oversaturation in the natural channel.”

A potential bright spot was contained in the financials released by Charlotte’s Web. The company reported that direct-to-consumer sales represented 57% of 2019 revenues, and was the fastest growing channel. This is welcome news in light of the COVID-19 pandemic, which has resulted in many small independent retailers that sell CBD products to close their doors.

How demand for hemp-CBD will fare in the current COVID-19 crisis remains to be seen. CBD products should remain available to consumers, both physically in national grocery and pharmacy chains that are deemed essential businesses and exempted from shutdown orders, as well as through e-commerce channels. Although not a direct comparison, cannabis, hemp’s high-THC cousin, has seen surges of demand in states where it is legal, as consumers stocked up in late March ahead of stay-at-home orders from state and local officials. Additionally, a recent report from Bloomberg cites survey data that shows demand for cannabis is inelastic, similar to alcohol, even in an economic downturn.

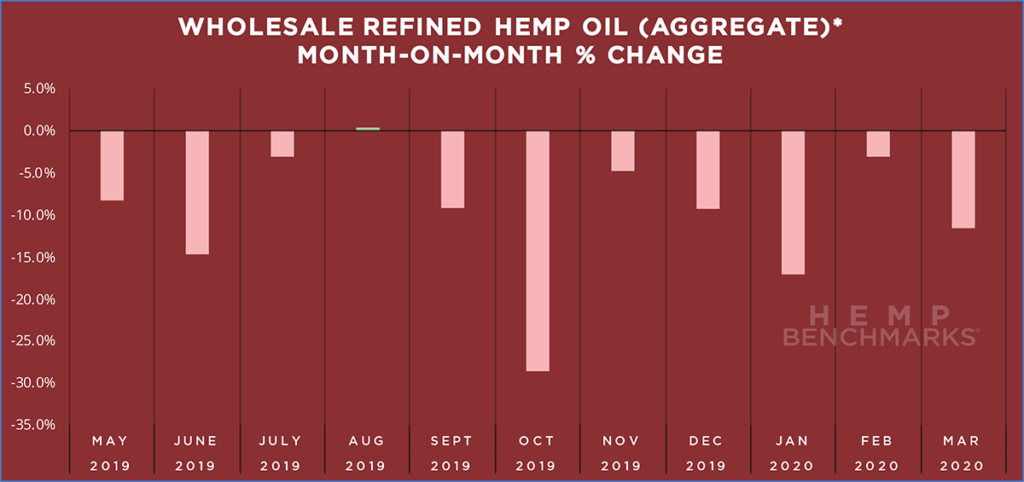

Whether this will be the case for hemp-derived CBD is uncertain. However, given the price declines for CBD biomass and extracted forms of the cannabinoid over the past year, lower retail price points could encourage continued purchasing. Several members of our Price Contributor Network have stated previously that they would like to see retail CBD prices lowered in order to expand the consumer base for CBD products. Meanwhile, an executive at a Florida-based hemp cultivation and processing operation stated to our analysts in late March that he had observed lower retail prices leading to increased sales even as the COVID-19 pandemic gripped the U.S. in earnest.

*The Hemp Benchmarks Refined Hemp Oil (Aggregate) product category is made up of the price assessments for the Distillate – Full Spectrum, Distillate – Broad Spectrum, and Distillate – THC Free product categories. The definitions of our product categories can be found here.