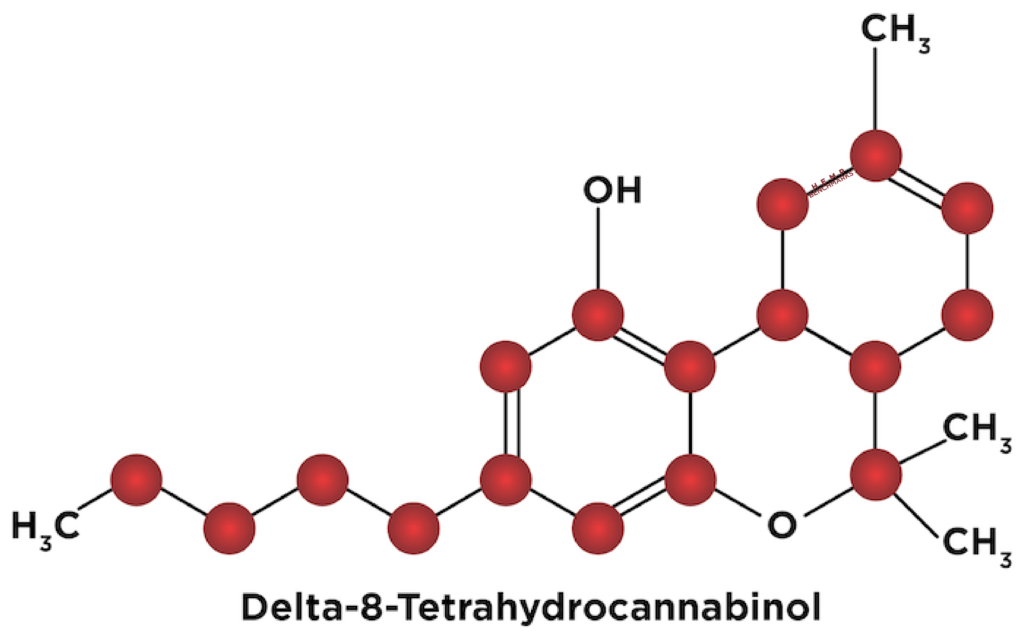

With rates for CBD and CBG extracts falling, a new development observed in our August price data was transactions involving delta-8 THC products. Delta-8 THC is not derived from hemp plant material, but synthesized from extracted CBD. It is also a psychoactive cannabinoid; in other words, it will get users “high,” though reportedly in a manner distinct from delta-9 THC.

Confirmed transactions for delta-8 THC Distillate reported in August by our Price Contributor Network varied widely. However, even the lowest-priced deals for delta-8 THC Distillate settled for more than the assessed prices for both THC Free CBD Distillate and CBG Distillate. Observed asking prices on exchanges and marketplaces exceeded the average confirmed transaction prices by several thousand dollars. Some sellers are also infusing smokable hemp flower with delta-8 THC distillate. Such product is being hawked at high asking prices, easily double or triple those of even higher-priced smokable CBD flower.

Is Delta-8 THC Legal?

While there is burgeoning interest in delta-8 THC in the U.S. hemp industry, its legal status is uncertain. Additionally, newly-proposed regulations from the Drug Enforcement Agency (DEA) would classify delta-8 THC as a schedule I controlled substance, making it illegal federally and forestalling its market potential.

The DEA released its Interim Final Rule (IFR) for CBD and other hemp derivatives on August 20. Titled “Implementation of the Agriculture Improvement Act of 2018” in the Federal Register, the proposed rules make several unremarkable technical changes to align DEA regulations and definitions of terms with the 2018 Farm Bill.

Certain parts of the proposed regulations, however, consist of DEA interpretations of gray areas of the Farm Bill, including those dealing with delta-8 THC and other synthetically-derived forms of THC (tetrahydrocannabinols). As cannabis and hemp business attorney Rod Kight pointed out in a recent blog post, the DEA IFR states, “For synthetically derived tetrahydrocannabinols, the concentration of delta-9 THC is not a determining factor in whether the material is a controlled substance. All synthetically derived tetrahydrocannabinols remain schedule I controlled substances.”

Consequently, if the DEA IFR was to go into effect as written, then delta-8 THC synthesized from CBD would be illegal and current interest in the compound would be a dead end for businesses. And, while Kight asserts, “It is clear that [delta-8 THC] which is naturally expressed in the hemp plant is not a controlled substance;” he also notes, “Current hemp cultivars do not express [delta-8 THC] in sufficient concentrations or quantities to be economically viable to extract it for commercial purposes.”

As alluded to, the DEA IFR is not final. Public comments on the proposed regulations are being accepted until October 20.

What Might a Delta-8 THC Market Look Like?

Until the DEA rules are finalized – or until some enforcement against delta-8 THC production and distribution occurs – Hemp Benchmarks expects interest in the novel cannabinoid to continue to grow. As we pointed out at the outset, prices for CBD and CBG extracts have continued to decline. Many processors are already sitting on sizable inventories of such products, particularly extracted forms of CBD. Given this situation, synthesizing delta-8 THC from one’s surplus inventory of CBD and selling it for significantly higher prices would appear to be an appealing avenue for processors to take.

However, delta-8 THC’s market potential is hazy at the moment, due both to regulatory uncertainty and the fact that most consumers are unfamiliar with the compound. Since it is psychoactive, the consumer base for delta-8 THC may align more with that for delta-9 THC marijuana, rather than hemp-derived CBD and other non-psychoactive cannabinoids that have a broader appeal. The fact that some businesses are already infusing delta-8 THC Distillate into smokable hemp flower suggests that they are aiming, at least in part, for consumers who already smoke marijuana.

In any case, potential consumers will have to be educated and demand generated, as it is not necessarily latent. Regarding this type of marketing strategy for novel cannabinoids, the sales director of a vertically-integrated hemp-CBD company in Oregon observed to Hemp Benchmarks last month, “the method seems to be [first] isolate the minor [cannabinoid], [then] try to find a market for it. To me that is a little backwards and ends up creating these supply problems we see.”

He went on to state that he expects an oversupply of delta-8 THC to develop if federal officials do not first move to curtail its production and sale. The CBG market may provide a possible glimpse into the future of delta-8 THC prices. Last year, CBG was hailed by some as the next big thing in the hemp-cannabinoid industry. However, widespread demand has not manifested and CBG product prices have declined precipitously.

Hemp Benchmarks first began publishing price assessments for CBG Biomass in November 2019. In the nine months since then, the price for CBG Biomass has dropped by 82%. From February 2020 through August 2020, our assessed price for CBG Distillate declined by the same proportion. This price erosion occurred prior to this year’s harvest, which will generate an increased supply of CBG hemp compared to last year.

Overall, the market potential for delta-8 THC is highly uncertain at the moment, even notwithstanding its hazy legal status. As part of our mission to bring transparency and efficiency to the hemp supply chain, Hemp Benchmarks will publish expanded coverage of delta-8 THC product prices, as well as analysis of market and legal developments, in future Hemp Spot Price Index reports.