Just two weeks ago, we provided an Outlook for U.S. Hemp Production in 2020. However, new information suggests that growers may be pulling back this year, particularly in states with more mature hemp programs. This update will also incorporate some responses to a survey that Hemp Benchmarks circulated in April, requesting information on how the COVID-19 pandemic was impacting hemp businesses. More extensive coverage of the outlook for cultivation in 2020 and impacts of the coronavirus on the hemp industry can be found in our recently-published April Hemp Spot Price Index Report.

Hemp Cultivation Essential, Licensing Continues Relatively Smoothly

Some positive news in light of COVID-19 is that hemp cultivation has been considered an essential business by virtue of its status as federally-legal agriculture. Additionally, reports from state officials and farmers indicate that obtaining a license to grow hemp in 2020 has not been impacted by the pandemic and accompanying restrictions. Almost 90% of our survey respondents reported that they had not had any issues obtaining a license or registration for their hemp business as of early-mid April. (Almost 60% of respondents identified themselves as cultivators.)

Registrations to Grow See Slowdown in Some States; May be Offset by Enthusiasm in New Programs

“Things appear to be slowing down, growth-wise.” Brian Koontz, Industrial Hemp Program Manager for the Colorado Department of Agriculture (CDA), said in an email to Hemp Benchmarks in April. “Based on what we’ve seen so far and heard from industry, growth of [the] hemp industry may be marginal in 2020.”

Andy Gray, Hemp Program Coordinator for the Montana Department of Agriculture reported a pullback in applications. Last year, Montana hemp farmers planted the second most acreage of any state after Colorado. This year, Gray stated, “Our application numbers are down so far … Partly due to COVID and partly because of the market.”

A report from the Capital Press noted a slowdown in hemp cultivation licensing in Oregon, another of the country’s top hemp producing states. According to the report, about 6,300 acres were registered for hemp growing in Oregon in Q1 2020, down more than 75% from the 25,400 acres registered during the same period in 2019.

However, states with new programs are seeing the enthusiasm over the prospect of hemp farming. Florida began accepting applications for hemp licenses for the first time on April 27. Holly Bell, Director of Cannabis at the state Department of Agriculture and Consumer Services, told Hemp Benchmarks that, as of May 1, there had been 817 total applications submitted and 123 cultivation licenses already approved.

Similarly, in Texas, which is also undergoing its first season of legal hemp growing, local outlet KVUE reported that over 450 applications for producer licenses had been received by the state agriculture department as of early April. Indiana, entering its second season of legal hemp farming in 2020, also reported to Hemp Benchmarks an uptick in licenses and acreage compared to last year, though the state’s program remains relatively small.

Slow Sales Prompt Licensed Farmers to Reconsider

Some farmers report that sluggish sales are causing them to rethink prior plans for 2020. Annette Wiles, co-owner of Midwest Hop Producers in Nebraska, told Hemp Benchmarks that she is reconsidering previous plans to expand hemp cultivation. Wiles said she would like to offload inventory from a prior harvest before growing additional crops.

Midwest Hop Producers is a small operation focused on growing and selling smokable high-CBD hemp flower, but those growing high-CBD biomass for extraction have also had a tough time moving their 2019 harvests. As we have detailed previously, reports from regulators and producers tell of large volumes of biomass still sitting unsold, which may dissuade some from growing again this year.

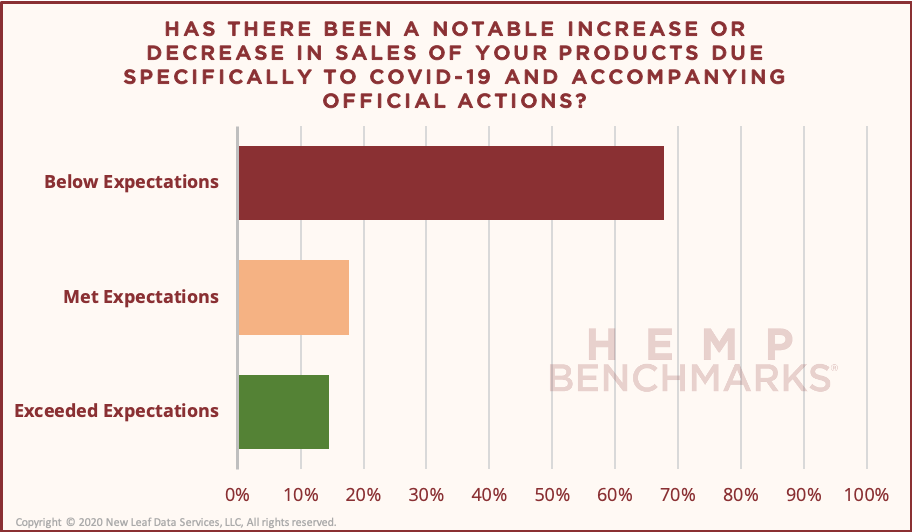

Nearly 70% of survey respondents reported that their sales as of April were below expectations due specifically to COVID-19. Some also emphasized that moving their production – whether hemp plant material or extracted CBD – was quite difficult even before the pandemic.

Numerous Variables Make 2020 Production Difficult to Project

As noted above, 2019 saw much less acreage planted and harvested successfully than was actually registered. Given that knowledge, it is possible that slowdowns in licensing in more mature states may not translate to major contractions in production, especially if experienced, established farmers are remaining in the industry while newer entrants drop out after a tough 2019. The flip side of that possibility is that the surge in licensing in states with new hemp programs may not translate into greatly increased production of viable biomass. New hemp farmers may have more difficulties getting crops in the ground, and could see lower yields, lower quality harvests, or lost crops due to inexperience with the hemp plant.

Weather conditions will of course play a significant role in the success or failure of all farmers. Meanwhile, the COVID-19 pandemic has some growers concerned about possible labor shortages, which could impact the harvest season if the virus persists in some areas or rebounds in the fall. Survey responses indicated that labor shortages were not yet a widespread issue in April.

Finally, our reporting to this point indicates that growing hemp for CBD and other cannabinoid extraction will remain the goal of the vast majority of U.S. producers in 2020. However, there is increasing interest in other end markets, particularly that for hemp fiber, and cultivation for industrial applications will likely constitute a larger portion of total production compared to 2019.