February 2020 Price Commentary

Assessed prices for every product category, apart from the new ones introduced this month, declined in February. Similar to last month, some of the biggest proportional declines observed were for larger volume deals of CBD biomass. Reports from officials in Minnesota and North Carolina this month stated that farmers in those states are continuing to sit on unsold production from 2019 and have been compelled to shop their crops around in other states, often selling smaller volumes piecemeal when buyers can be found.

While CBD biomass prices continued the slide that has been observed since last spring, the rate of decline documented this month was significantly smaller than in January, when the aggregate price for all deal sizes dropped by over 30%. Identifying a definitive market bottom in this new and still-developing industry is likely not possible at this point, but the slowdown in the rate of decrease in CBD biomass prices suggests that we may be approaching the current floor.

This month, we are introducing price assessments for CBG Seeds, CBG Clones, CBG Distillate, and CBG Isolate. All command significant premiums over their CBD counterparts, particularly CBG Isolate, which has an assessed price nearly seven times this month’s rate for CBD Isolate.

In regard to extracted CBD products, prices continued to compress this month, although some stabilization was observed. Processors that are sitting on large inventories are reportedly beginning to slash prices just to move product and generate cash flow, as sales channels remain flat while CBD remains in a regulatory limbo. Observed low spot prices for Crude and Broad Spectrum Distillate were reported at under $300 and $1,000 per kilogram, respectively, representing significant reductions from the low ends of the pricing spectrums for those products last month. Additionally, market participants are apprehensive that prices for CBD oils could be depressed further due to the bankruptcy of major Kentucky-based processor GenCanna. If GenCanna’s inventory is liquidated at below-market prices, CBD oils could suffer further price pressure in the coming months.

February 2020 Hemp Spot Price Index Report Headlines

Price Commentary

Prices continue to slide, but some stabilize. New CBG price assessments introduced.

Projections for the 2020 Season

U.S. hemp production appears likely to expand in 2020, but not by as much as it did in 2019 as some farmers are hesitant.

State Hemp Program Statuses

Some states continue existing pilot programs, putting off compliance with USDA rules until later this year.

Federal Regulatory Update

USDA states change to THC limit requires Congressional action; new insurance options for farmers introduced.

Industry Developments

Weather contracts as a risk-management option; major CBD processor files for bankruptcy.

Research

Cornell University researchers conclude genetics are the biggest factor in causing hot hemp.

State Updates

Official 2019 production data received from Arizona, Illinois, Indiana, and Minnesota.

State Updates Highlight

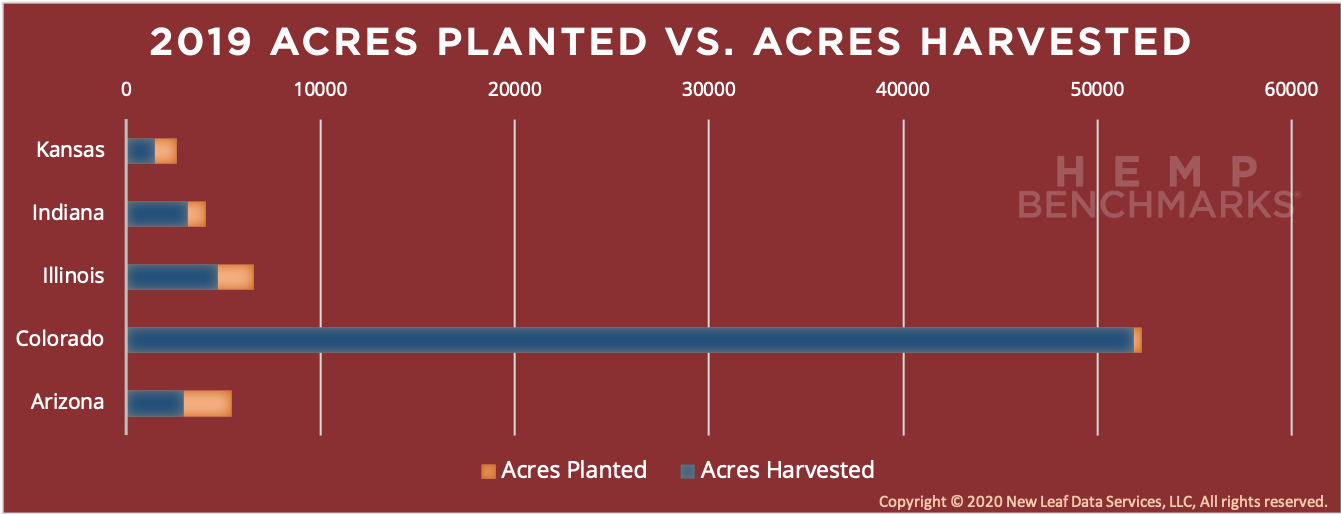

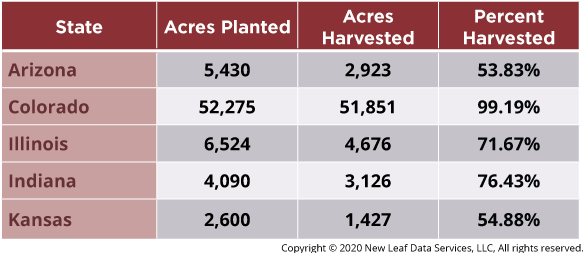

While the proportion of Colorado’s planted acres that were harvested is extremely high, state agriculture officials have stated to Hemp Benchmarks that some farmers did not turn in their reports and they suspect the overall crop failure rate was higher. Arizona may well have seen over 70% of planted acreage harvested, but a significant portion of the state’s crop was destroyed because of non-compliant THC levels. Illinois’ high percentage of planted acres harvested belies the fact that only about 30% of registered acres were planted and state data indicates yields were generally low.