Hemp Benchmarks, in conjunction with AlmaStone, developed a survey and circulated it to processors in the U.S. extracting CBD and other cannabinoids from hemp biomass, garnering dozens of responses. In what follows, we analyze the results of our first U.S. Hemp Extraction Survey. [Editor’s Note: The totals for some questions add up to more than 100% as respondents could select more than one option.]

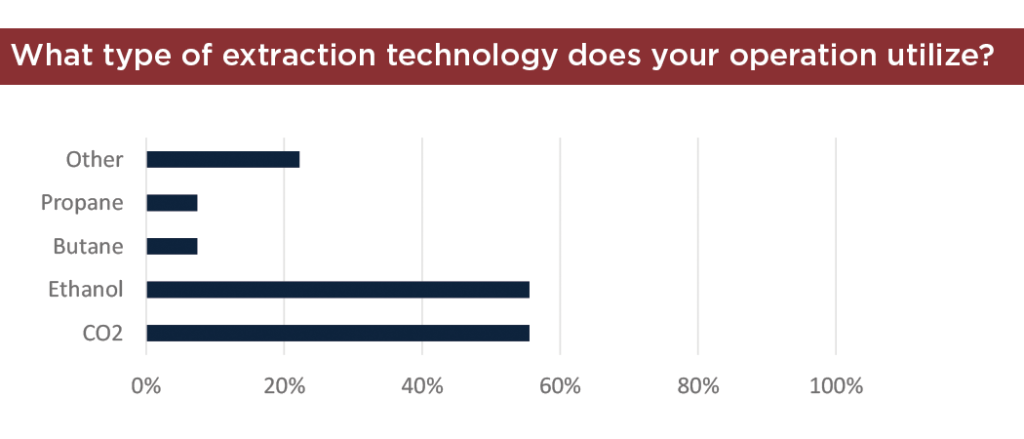

Survey results show that hydrocarbon extraction – the use of butane, propane, or other related solvents – is employed by a minority of respondents. This is in contrast to the legal cannabis industry, where hydrocarbon extraction was the dominant method early on and remains extremely prevalent. Instead, most hemp processors that responded to the survey use ethanol or carbon dioxide to extract CBD and other cannabinoids from hemp.

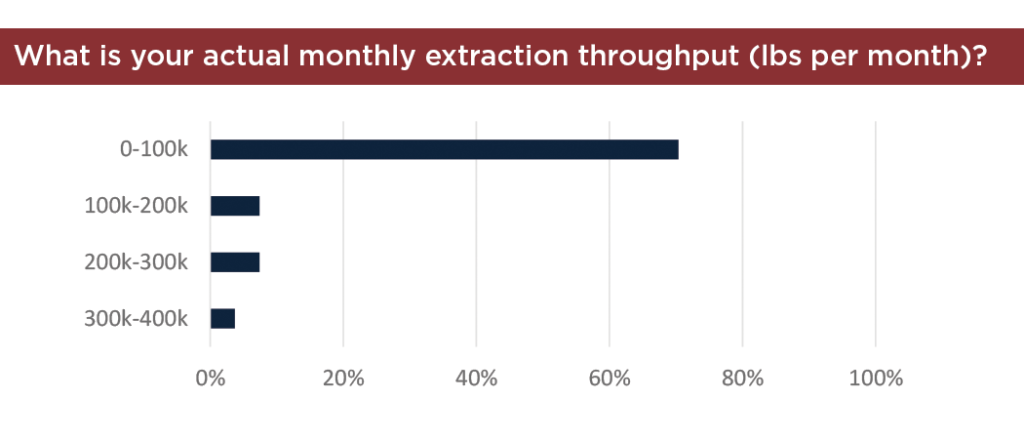

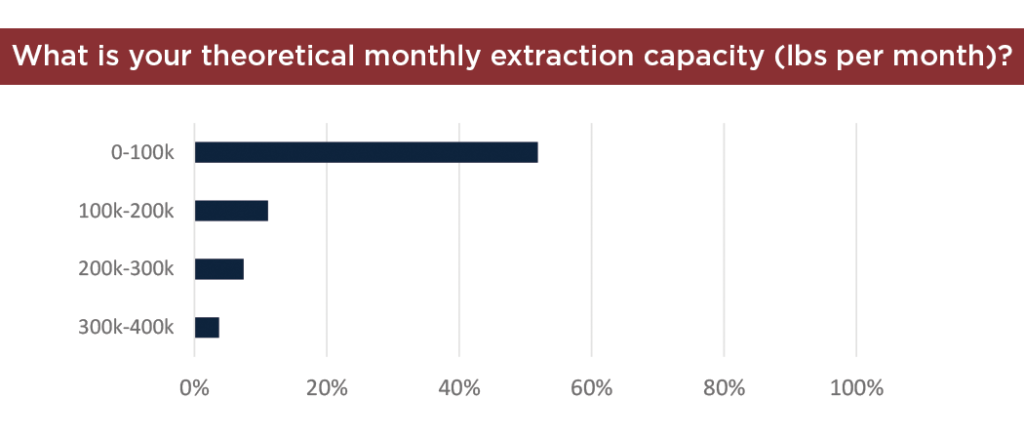

The use of ethanol rather than hydrocarbons by a majority of survey respondents is likely due to the fact that processors extracting CBD from hemp are dealing in significantly larger throughput volumes than those extracting cannabinoids from cannabis / marijuana. Still, the survey results show that 70% of respondents have an actual monthly processing capacity of 100,000 pounds of biomass or less.

Also in regard to processing capacity, the survey results suggest that larger extractors are currently running at or near their theoretical throughput; the proportions of respondents that identified the three higher volume brackets as their actual processing capacity and theoretical processing capacity are quite comparable. However, it does appear that some respondents that are currently processing 100,000 pounds of biomass per month or less have the theoretical capacity to process up to 200,000 pounds monthly.

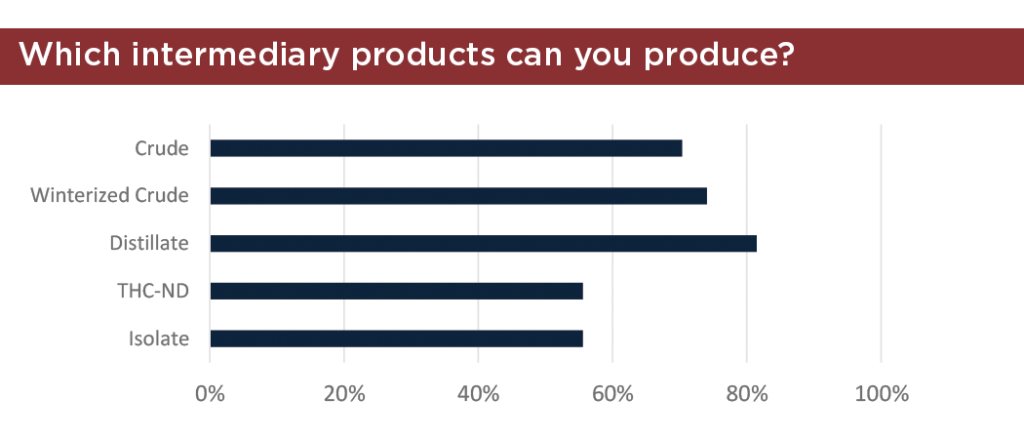

Of the products generated by extractors, distillate is the one produced most broadly by survey respondents, even more so than different forms of crude CBD oil, which is the initial step in making both distillates and isolate. While over 80% of respondents are making distillate, though, only about 55% stated that they are making THC-free distillate (THC-ND), suggesting that a significant portion have not made the investment in the equipment and other resources required to remove THC completely from Full or Broad Spectrum Distillate.

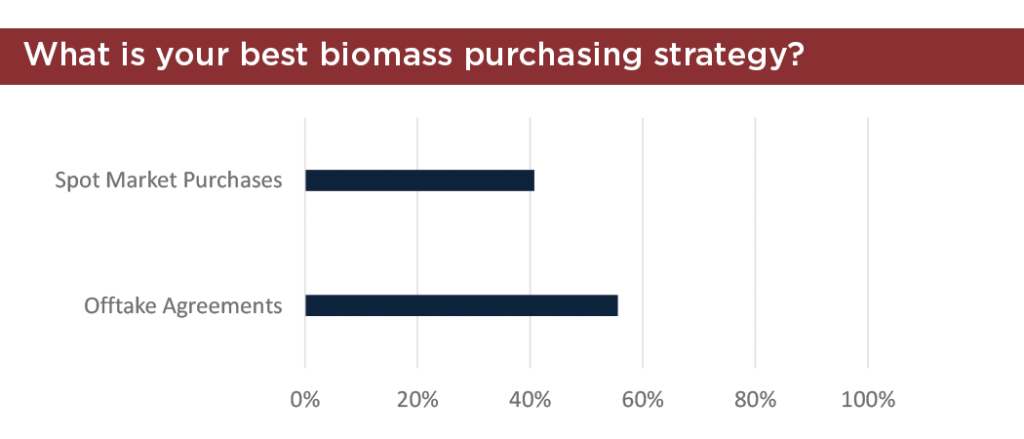

Other survey questions concerned approaches to bringing in biomass and prices for extracted CBD products. It is important to note that the survey was circulated in mid-October, with responses received in the weeks subsequent.

At that time, less than half of respondents were purchasing biomass outright, instead favoring offtake agreements. Based on feedback from market participants in recent months, it seems likely that the proportion of processors purchasing biomass has contracted in the wake of the harvest.

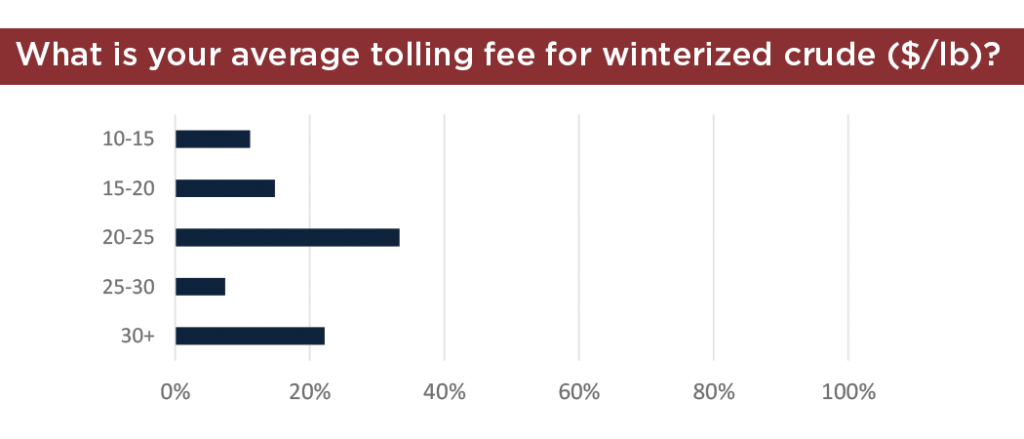

In regard to offtake arrangements, about a third of the extractors who responded to the survey stated that their tolling fee was between $20-$25 per pound of biomass. With prices for biomass and extracted products falling in the wake of the harvest, however, it is easy to see how farmers would balk at such tolling rates. Recent remarks to our analysts from market participants suggest that lower prices overall have pushed down tolling fees, with many stating that rates around $15 per pound of biomass are now more common.

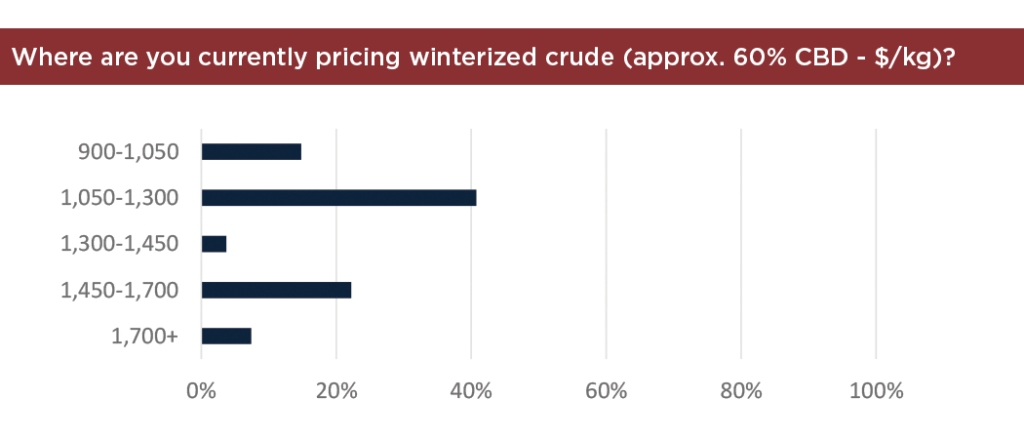

Survey results examined in conjunction with more recent Hemp Benchmarks price assessments indicate that processors are seeing their margins squeezed along with farmers. December’s assessed price for winterized crude, $890 per kilogram, is at the bottom end of the lowest price bracket for such product included in the survey. Only about 15% of respondents stating that they priced their crude at or around this level, while the rest were setting prices higher at the time of the survey.

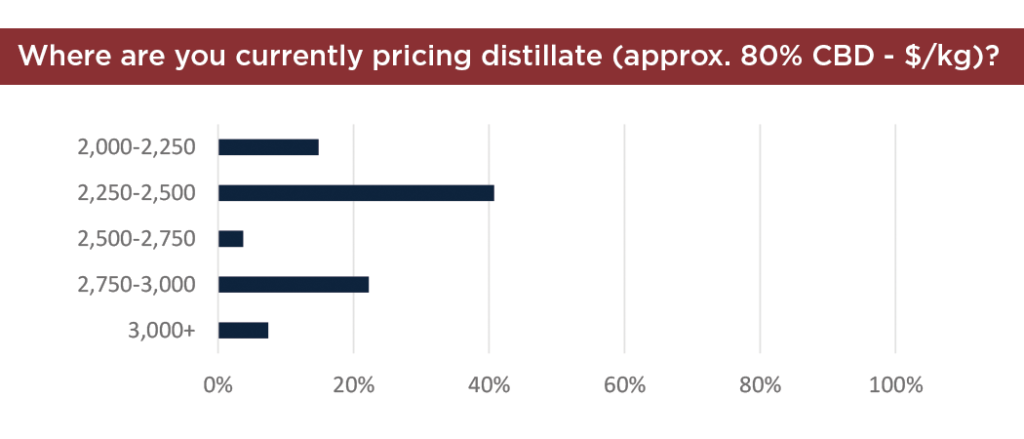

Meanwhile, distillate prices have held up better, with even Full Spectrum Distillate, which contains THC, seeing an assessed price of $2,920 per kilogram in November. Only about 30% of survey respondents stated that they were pricing their distillate around or above that level, with the rest answering that they set their distillate prices at $2,750 per kilogram or lower. This month, however, rates for Full Spectrum Distillate declined to $2,445 per kilogram, more in line with the survey responses.