Hemp Benchmarks, in conjunction with AlmaStone, developed a survey and circulated it to registered U.S. hemp farmers, garnering hundreds of responses. In what follows, we analyze the results of our first U.S. Hemp Crop Survey.

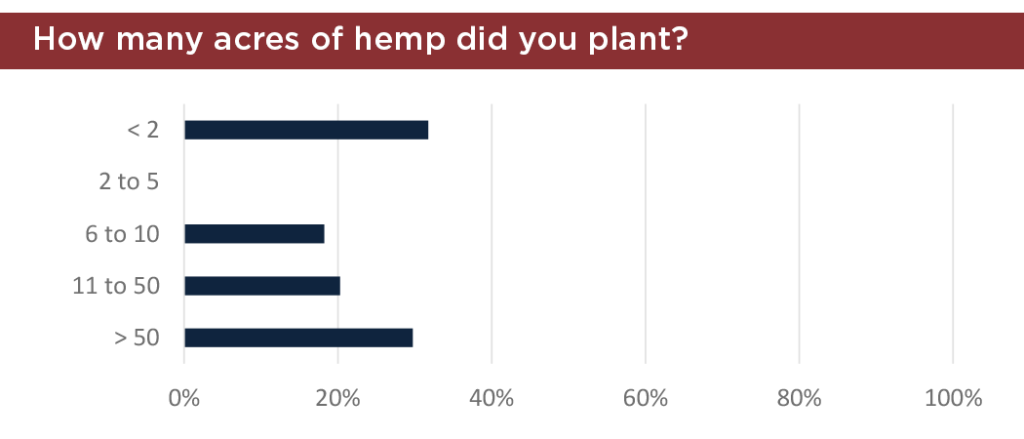

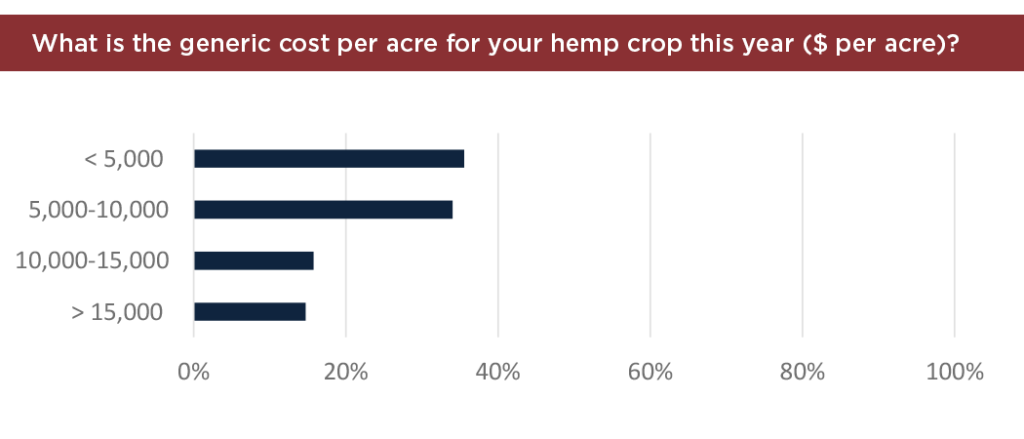

Survey results show that most respondents are small farmers, with roughly a third planting only two acres of hemp or less. Overall, about 70% of respondents planted less than 50 acres this year. Some general agreement on how much it costs to farm hemp was also revealed by the survey results. Over two-thirds of respondents answered that their costs per acre were $10,000 or less.

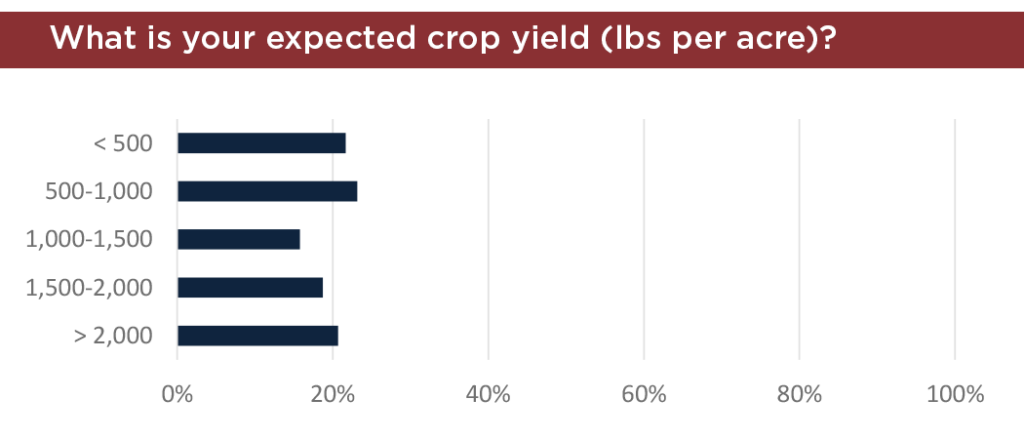

Expected yields varied widely, however. Comparable proportions of respondents answered for each of the five yield brackets provided, from under 500 pounds per acre to over 2,000 pounds per acre. Responses to this question illustrate the lack of standardization in the industry, particularly in regard to genetics and cultivation practices, as well as varying levels of experience amongst those farming hemp.

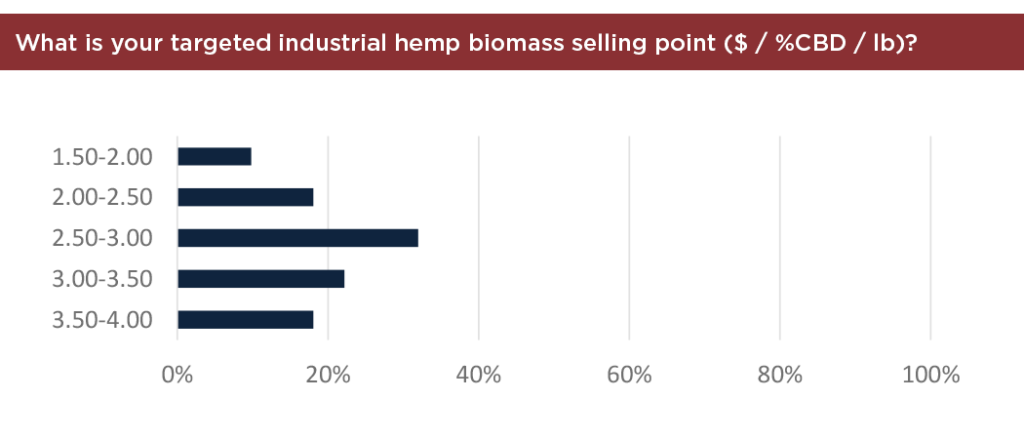

Finally, our recent price assessments for hemp biomass, viewed in conjunction with the survey results, indicate that many farmers are not obtaining the prices that they targeted for their produce. In the largest single category to receive answers, about a third of respondents stated that they targeted a price of between $2.50 – $3 / %CBD / pound for their biomass, while about 40% of growers targeted a price of above $3.00 / %CBD / pound. Only about 10% of respondents targeted a price between $1.50 and $2 / %CBD / pound, which is more in line with recent Hemp Benchmarks price assessments for such material.

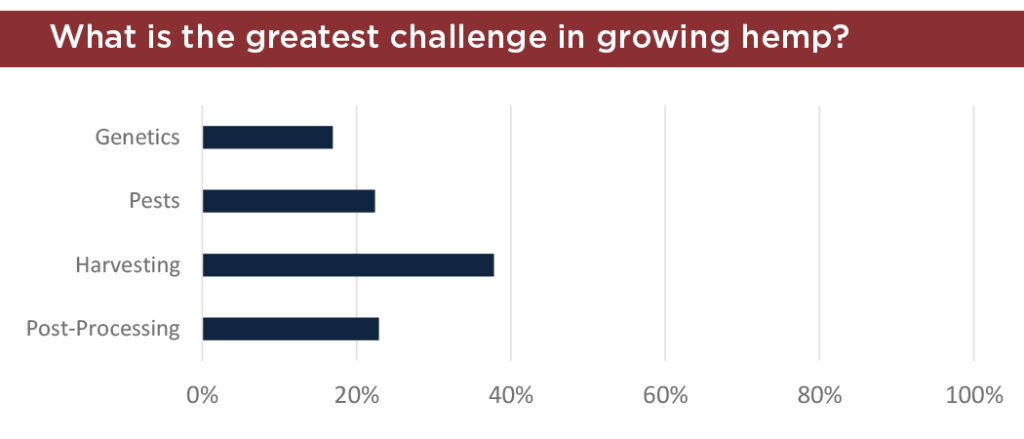

In our previous reports, and in this one, we have outlined the numerous challenges faced by farmers in the recently-concluded growing season. However, according to responses to the survey, farmers generally viewed their biggest challenge as simply getting their crop out of the field, with almost 40% identifying harvesting itself as the highest hurdle to clear. Dealing with pests and getting one’s hemp processed were characterized as comparable challenges based on the survey, with just under 25% of respondents identifying one of those difficulties as their most pressing.

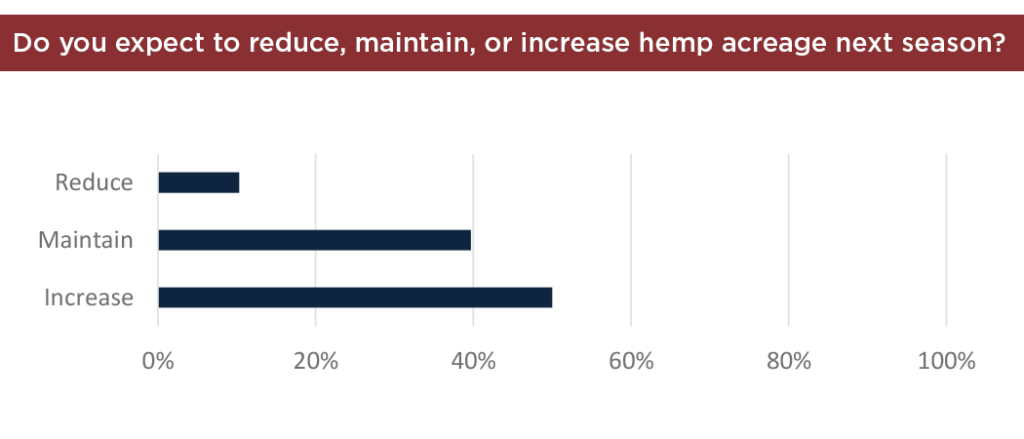

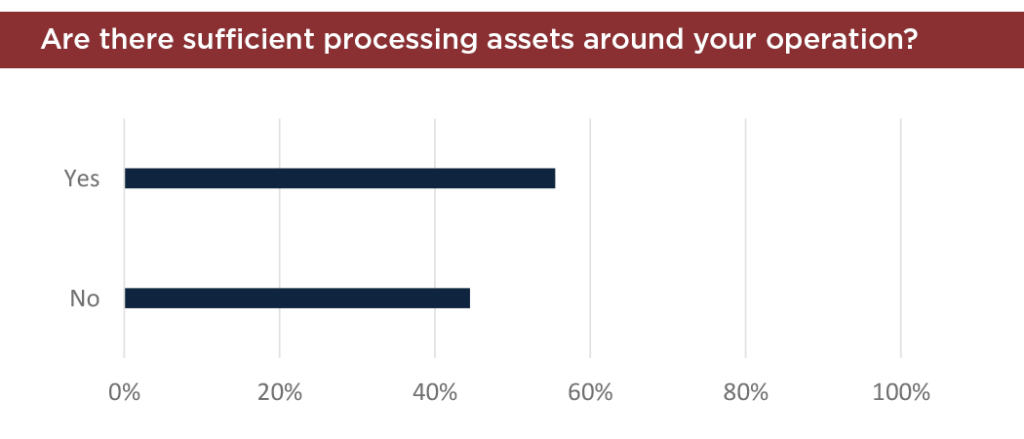

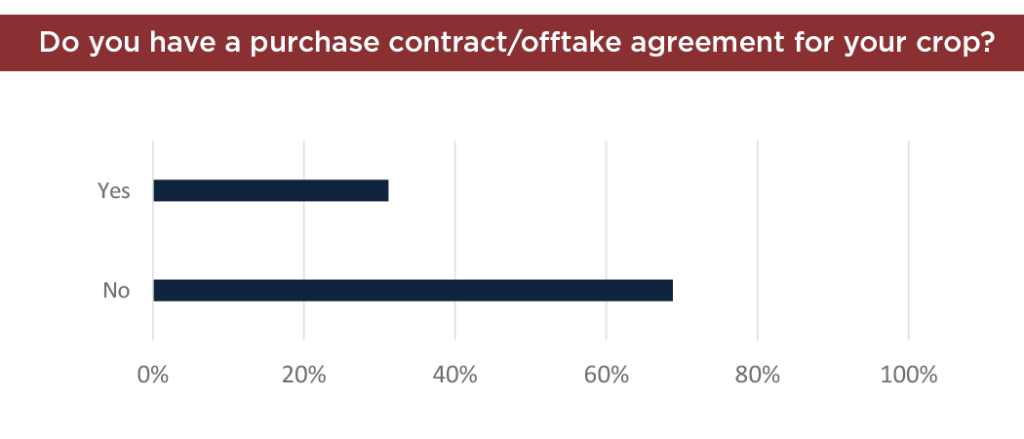

Still, a majority of survey respondents stated that they believed there are sufficient processing assets in the vicinity of their farm or growing facility, although over two-thirds responded that they did not have a purchase agreement for their crop at the time the survey was circulated. Despite these challenges, only 10% of respondents said that they planned to reduce the amount of acreage farmed next year, with half answering that they plan on expanding in 2020.