With most domestic hemp producers and processors focused on the production of cannabinoids, primarily CBD, the size and growth of the CBD market are key issues for all market participants, while the impact of COVID-19 raises a new concern. Prior to the emergence of the pandemic – and the stay-at-home orders and business closures implemented to mitigate its spread – there were indications that the CBD market might not meet lofty growth expectations for 2020. Several publicly-traded CBD companies reported declining revenues in Q1 2020, before the full impact of the coronavirus was felt across the country.

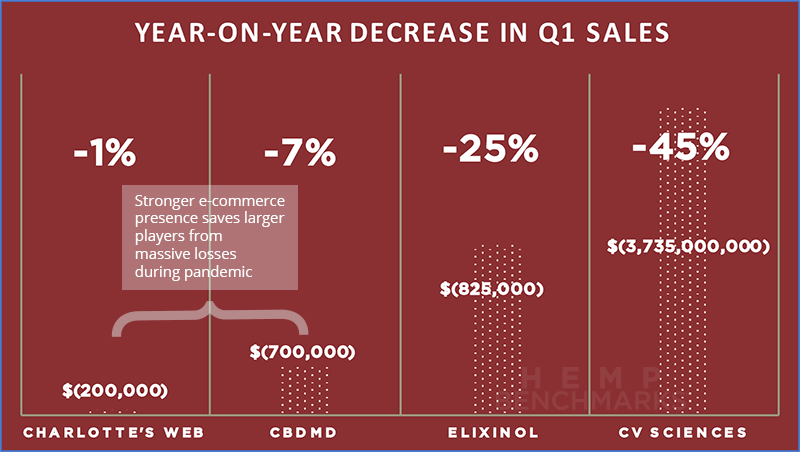

For example, Charlotte’s Web reported that sales in Q1 2020 declined for the second quarter in a row, to $21.5 million, which is a bit under $21.7 million in revenue in Q1 2019. Similarly, cbdMD had its first sequential decrease in revenues in Q1 2020, to $9.4 million, from $10.1 million in Q4 2019. Charlotte’s Web and cbdMD, however, both benefited from a large percentage of online sales.

CV Sciences and Elixinol, companies with smaller online presences, suffered larger revenue declines. CV Sciences reported earnings of $8.3 million for Q1 2020, a 45% drop year-over-year and an 11% decline from Q4 2019. This despite a 42% increase in the number of retail stores carrying CV Sciences products. Elixinol’s Q1 2020 revenues slipped by 25% from Q4 2019, to $3.3 million.

All of the aforementioned companies, however, saw an increase in the percentage of revenues generated by online sales. For example, Charlotte’s Web’s direct-to-consumer ecommerce sales grew by 29% year-over-year, to account for almost 66% of total revenues in Q1 2020, up from 50% of sales in Q1 2019. CV Sciences saw online sales expand to 24% of revenues in Q1 2020, from 15% in the same period a year ago.

In the face of existing headwinds, how is COVID-19 impacting the CBD market? On one hand, CBD’s purported – but largely unverified – abilities to mitigate stress, anxiety, and insomnia suggest the possibility of increased consumer demand under current conditions. On the other hand, the pandemic has had a significant impact on existing sales channels, as many brick-and-mortar stores that carry CBD products have been compelled to close under stay-at-home orders. As demonstrated above, COVID-related lockdowns have increased the importance of a strong online presence. Notably, Green Growth Brands filed for protection under the Companies’ Creditor Arrangement Act (the Canadian equivalent of Chapter 11) and shuttered its chain of retail CBD stores, Seventh Sense, when malls in Canada were closed.

It is unclear if CBD product sales have increased in stores that were deemed to be essential and remained open during lockdowns. An April report from New Hope Network noted that brands and retailers are reporting record sales growth in the immunity supplement category, from vitamin C to elderberry. CBD sales, however, have been flat: “There is some lift in virtually every area in supplements,” Kathryn Peters, executive vice president of business development for SPINS, stated in the report. “Except perhaps for CBD. That’s a bit of an anomaly.”

In sum, there remains little hard data on the current size or growth rate of the U.S. CBD market. Whether the coronavirus will have a positive or negative impact on the market also remains to be seen, with many unknowns and a significant distance to travel before the pandemic is contained and resolved in America. What is clear is that the CBD market needs to expand significantly to absorb the large inventory of hemp-derived extracted products that are currently on hand, not to mention any new production planned for 2020.

Ultimately, the most significant impact of COVID-19 on the U.S. CBD market may be an even longer delay in the U.S. Food and Drug Administration’s (FDA) rulemaking, as the agency’s immediate focus must be on approving drugs and vaccines that can fight the pandemic. The projected growth of the CBD market remains largely dependent upon the FDA promulgating rules and regulations that will provide clear guidance on whether and how companies can utilize and market CBD in food, beverages, and dietary supplements. Until there are clear guidelines from the FDA, most major consumer packaged goods, nutraceutical, and dietary supplement companies will not incorporate CBD into their product lines, and traditional retailers will refrain from selling ingestible CBD products.