In last week’s Hemp Market Insider, we discussed how veteran hemp farmers are applying the lessons learned over the past several seasons to their preparations for this year’s crop. Some of the “lessons learned” include methods intended to make one’s operations more efficient. In what follows, we note some additional tools and approaches that hemp cultivators are employing to make their operations as cost-effective as possible.

From Farmers’ Almanac to “Seed-to-Sale”

Hemp market participants say that, with several seasons worth of information now available, the industry is ready to start using data-tracking technology to help guide its decisions on cultivar selection, planting, harvesting, and other crucial factors that can spell the difference between success or failure.

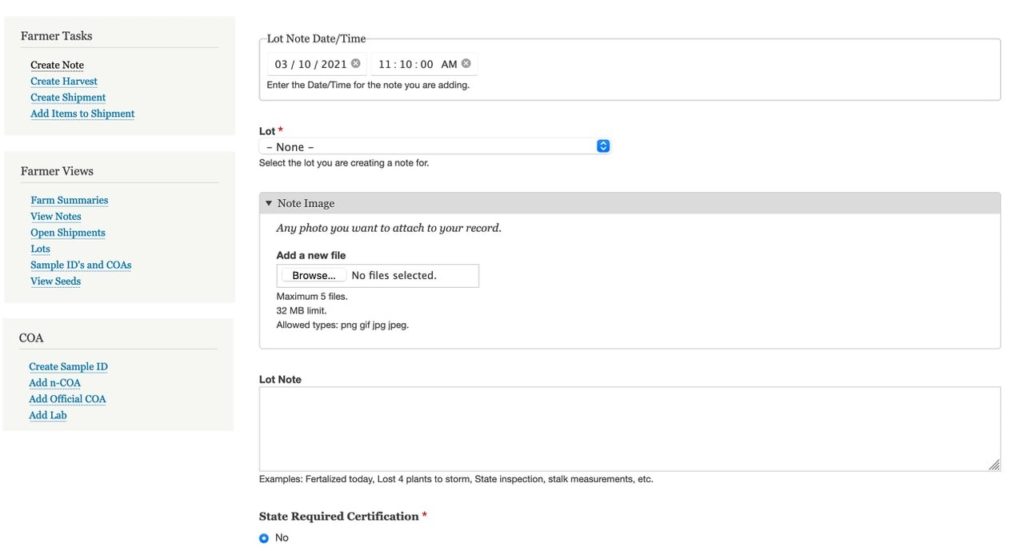

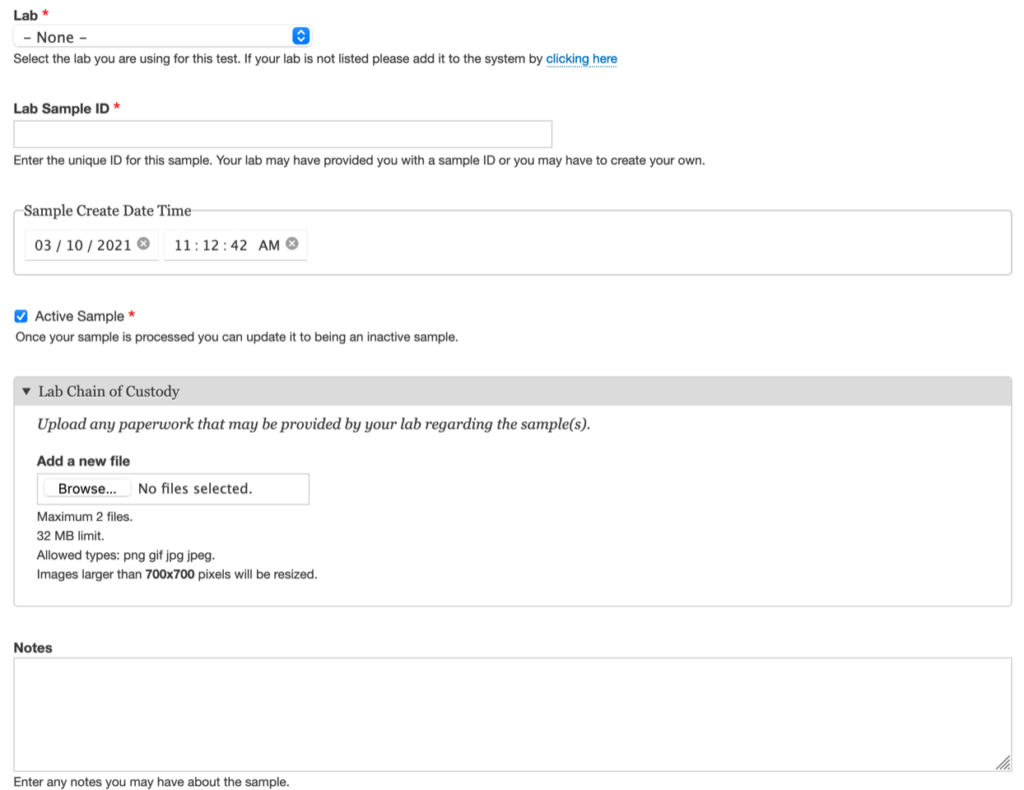

“People don’t recognize that agriculture in general is a dataset,” said Justin Trowbridge, co-founder and Business Development Officer at Hemp Batch Tracker, a Nebraska-based firm that has constructed a data collection and management platform to track hemp and hemp products from genetics to the end consumer.

“When you look at the Farmers’ Almanac, that is an analog dataset going back over 200 years,” Trowbridge told Hemp Benchmarks. “When you plant corn or soybeans you’re going to look at historical records and norms and genetics, and that just doesn’t exist in the hemp space yet. So the only way you can get to that … result is if you track the data points. And right now, other than using Excel or post-it notes, there isn’t a true platform to do that.”

So-called “seed-to-sale” tracking is mandated in state-legal marijuana markets, largely to ensure that all plants and products are accounted for within licensed supply chains. While not required by federal or state laws, Trowbridge said that tracking various aspects of hemp production can help growers optimize their operations. “You’re trying to repeat the same results year over year,” he noted, “and unless you track the data on how you got to your results, you’re basically shooting from the hip every year. So it’s helping people find and establish SOPs [standard operating procedures], good manufacturing, good farming practices, to meet with potential FDA regulations.”

Cost-Effective Cultivation Practices

In last week’s post, we noted that many hemp growers have scaled down and tailored their operations, frequently employing more automation and technology in pursuit of efficiency. Barrett Dash, Optimization Director, Farm Consultant, and Partner at Omnibudsman Enterprises in Oregon, confirmed those trends to Hemp Benchmarks. He also noted some low-tech and longstanding farming approaches that hemp growers are employing to cut down on overhead.

Dash provided some examples: “Instead of using plastic mulch a lot of our growers in Oregon are switching to using bio-mulch, which is made from biodegradable plant materials. A lot are also doing cover cropping with clover and mustard and other sorts of crops, to help with nitrogen and to help keep weeds down.” In addition to being more sustainable options, mulching and cover cropping can save labor costs by working to suppress weeds. Additionally, enriching one’s soil via these approaches can reduce fertilizer use, while mulching helps fields to retain water, reducing irrigation requirements.

Furthermore, as some growers scale down their operations, Dash stated that contracting out certain services no longer makes sense from a financial standpoint. “We are seeing a lot of the smaller growers starting to take some of the potential outsourcing operations in-house,” he told Hemp Benchmarks. “Things like doing seed sorting and cloning themselves, handling propagation.”

Right: CBD Seedling starts in greenhouse

Photos Courtesy: Barrett Dash

Finding Efficiencies in Vertically-Integrated Business Models

Still-developing supply chains and difficulty securing contracts for their crops have prompted numerous hemp market participants to integrate their businesses vertically, handling farming, product manufacturing, marketing, and sales under the same roof. While attempting to be a jack-of-all-trades does not typically lend itself to efficiency, growers are finding ways to lower costs and be effective in aspects of their operations that might not necessarily be within their core competencies.

For example, in some more established hemp-growing regions like Oregon, Dash said he is seeing more hemp businesses embrace the cooperative model, in which farmers pool their resources to help reduce costs and strengthen their product marketing.

On the marketing side, some in the hemp industry are employing QR codes, which not only allow products to be tracked back to their sources, but also provide an easy way for businesses to communicate additional information to customers and facilitate sales. “They can see whatever information that is relevant to [the product],” Trowbridge of Hemp Batch Tracker said, “so all social media links, websites to reorder products directly if they want to, video content explaining the difference between CBD and CBG, multiple COAs [Certificates Of Authenticity]. So we have the ability to put whatever we need to, from a data perspective, in front of a consumer.”

Be Careful Where You Cut

Efficiency should not necessarily be an end in itself, however, and Barrett Dash emphasized that it is important to carefully consider how to cut costs and maintain product quality in a competitive market. “It doesn’t matter if it’s cannabinoids or fiber, you need the right tools for the job,” he said. “When people cut costs they often cut costs on the seeds; a big mistake. Instead of buying quality they’re buying quantity.” In his view, a smaller, higher quality crop will serve a grower better than planting more acreage of genetics that might be weak, unstable, or go hot.

Overall, Trowbridge at Hemp Batch Tracker said he has been impressed with the versatility of those in the hemp industry when it comes to their ability to adapt to a constantly-changing agricultural and business environment. “Almost every time we talk to somebody, we learn something new,” he said. “People in the hemp industry innovate better than I think any other industry. And the technology side of it is starting to catch up to what people are doing. I’ve seen things on farms … where there’s no way I would have ever thought of that.”