With hemp crops defined as legal or illegal based on their THC potency, testing labs play a crucial role in the industry. Further down the supply chain, quality assurance and safety testing is necessary for consumers to have confidence in the plethora of consumable hemp products now on the market. State regulators have responded accordingly in recent years by putting in place more stringent testing requirements. Meanwhile, the constant, rapid development of the hemp sector has resulted in novel products – such as delta-8 THC and similar compounds – that public and private entities must address.

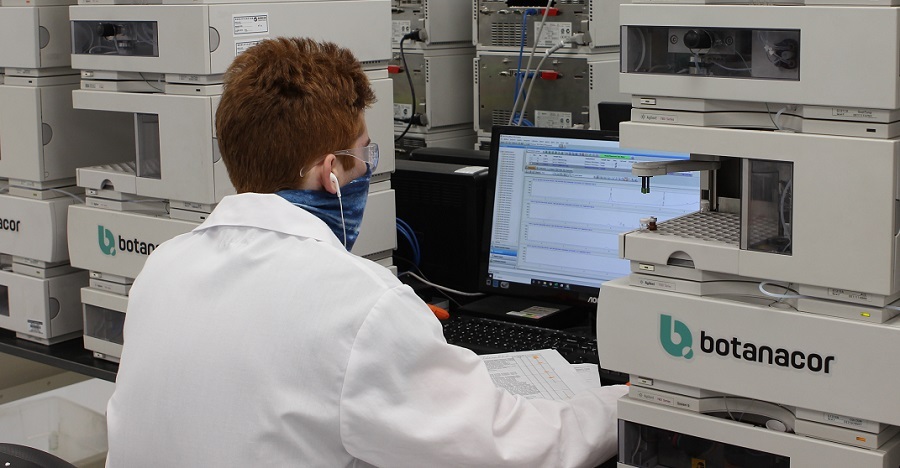

For more insight into the essential and quickly-changing field of hemp product testing, Hemp Benchmarks spoke to Carl Craig, CEO at Botanacor Laboratories. Botanacor is a Colorado-based, state-certified hemp testing facility that was founded in 2014, the year Colorado launched its hemp pilot program. Craig has a Ph.D in chemistry and has served in senior leadership roles at several commercial laboratories. He told Hemp Benchmarks that his company now performs between 4,000 and 9,000 tests on hemp samples each month. Along with determining THC potency, the laboratory also tests for heavy metals, microbials, pesticides, and other contaminants.

Hemp Testing Grows Up

Looking back, Craig noted that prior to the passage of the 2018 Farm Bill, the measure that legalized hemp nationally, many farmers and product manufacturers were only required, at best, to do minimal hemp testing for in-state purposes. In 2019, however, that all changed. “We had to expand to meet the growing demand for people wanting to test biomass,” Craig said. “Products came to us from all 50 states, also from Italy, Japan, South America; so we began testing on a more global basis.”

Like many aspects of the hemp industry, the testing sector dealt with its own version of the post-legalization “Green Rush,” according to Craig, when many tried to cash in on the new hemp market. “In 2019, when there was this explosion in the growth of products and biomass on the market … a lot of people got into the testing space, because they saw it as another product that they could charge for,” he said.

After the initial rush, however, the number of hemp testing facilities has plateaued. Craig attributed that development to a variety of factors including declining hemp prices, more stringent state regulations, and the expense of testing for an expanding list of contaminants, as is now required by several states, including those with major markets like California and New York.

Higher Standards Require More Professional Solutions

Indeed, the regulatory landscape for hemp testing has evolved dramatically over the past several years. For example, starting in April, Colorado, one of the leading states for hemp production and processing, will require the local hemp industry there to test for more than 100 different pesticides. “In the early days I could test for pesticides on a piece of equipment that might cost $20,000,” Craig remembered. “Now you’re talking about $200,000 and you need a couple of [those testing devices]. I think the market is going to stabilize for those labs that really have a business doing this.”

As a result of the evolution in the regulatory landscape, Craig described the hemp testing space as becoming more professional over the past several years, as well as more mission-oriented. The people now running and working at hemp testing facilities, he said, are not “doing it in their garage, it’s not what they’re trying to do on the side; it’s not what they’re doing just to make money. They’re doing it because they have the scientific expertise and the business charter to test these products for safety.”

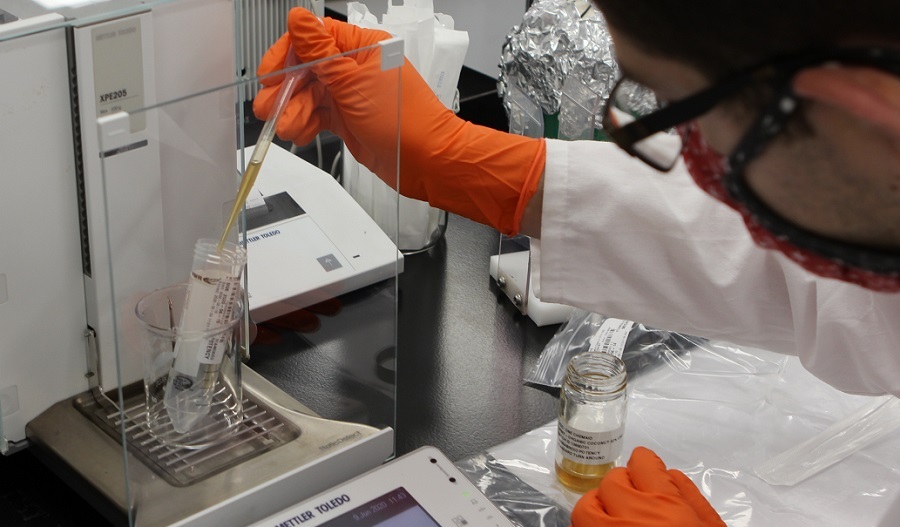

The industry’s constant evolution, Craig said, requires professional solutions. “If you think about it, one of the other challenges that the labs have is that the products come in every conceivable shape, color, size,” he pointed out. “Everything from bath bombs to topicals to soft gels to dog chews. Even socks! You really have to have some scientific acumen to know how to properly test these products, and make sure the testing you’re doing is accurate and reproducible.”

In the early days of hemp legalization, Craig said, would-be laboratories “could kind of fake that” expertise. However, he noted that as the industry matures, hemp product lines expand, and the regulatory demands become more stringent, hemp testing facilities are becoming much more like their counterparts in the food and drug sectors.

Labs Forced to Adapt to Unexpected Industry Developments

Craig said he was surprised at how rapidly the value of CBD has diminished over the past several years, as the cannabinoid’s market price tumbled due to severe oversupply. Like many in and around the industry, he was also caught off guard at how the CBD price drop in turn changed the hemp-derived cannabinoid market, sparking the introduction of delta-8 THC and other intoxicating cannabinoids that are synthesized from CBD.

“CBD went from being a valuable finished good … to a starting material that was very cheap,” Craig said. “The synthetics came to be, and I did not see that coming. Everyone knows you can make a lot of different cannabinoids starting with CBD, that’s how the plant does it.” However, when CBD prices fell dramatically, he observed, “people started saying, I’ve got all this [CBD], what can I do with it? They started making synthetic cannabinoids like delta-8, THC-O, and delta-10. And I did not see that coming. That surprised us.”

Craig also noted that his laboratory has been seeing some potentially hazardous materials in samples of delta-8 THC and other synthesized cannabinoids, especially those produced outside of current regulatory structures. “Most people are not sophisticated enough to remove all of those secondary products,” he said. “We don’t know if they’re dangerous, because in some cases I don’t know what they are, and in some cases we haven’t identified them yet.”

Along with that concern, Craig said a lot of delta-8 producers will overlook or ignore the fact that their products also contain substantial quantities of delta-9 THC, the intoxicating cannabinoid found in marijuana.

Not an Exact Science

Another challenge hemp testing facilities face, Craig noted, is explaining to hemp industry stakeholders that their testing results are not exact data. “When we tell you we have [determined] 6.5% CBG in your product, it doesn’t mean it’s 6.5%,” he said, “it means that it’s somewhere around 6.5%. Analytical chemistry is an estimate of a value, and there’s some uncertainty associated with it.”

Testing lab customers are often put off by their non-exact results. However, Craig said that uncertainty is part of the overall process. “Analytical science is difficult that way,” he added, “and unfortunately we’re forcing people who are not analytical scientists to understand that.”

The novelty of the hemp industry and its various products, along with shifting standards as regulators and businesses learn more about the plant and its compounds, has shined a bright light on hemp product testing. Craig pointed out that similar screenings take place in more mature industries as a matter of course, but are not scrutinized as closely due to those markets being stable. He elaborated: “The same thing goes on, for example, in organic produce testing. It’s just that you don’t see that. And the reason you don’t see it is that the regulators have said, ‘this is what’s considered acceptable.’ So, as consumers, we never get involved in it.”

State-by-State Patchwork Poses Problems, but Will Probably Persist

As industry stakeholders have discovered, such stability in regulatory standards does not emerge fully formed from the ether. The lack of federal regulation and guidance regarding CBD’s status in the marketplace, especially the well-publicized inaction by the Food and Drug Administration regarding the cannabinoid, was surprising to many who presumed quick approval of CBD as a dietary supplement would be forthcoming. However, based on his previous experience, Craig said the absence of fast, full clarity from the federal government is not unexpected.

“I have a long history in the testing sector, the very first of which was [in] the environmental industry, and they did the same thing,” he said. “What you had to test for in New Jersey was different than in Florida, was different than Montana – and so I think that’s the way it’s going to be [with hemp testing]. I don’t think the feds are going to rush in and save us. I believe that the states will come up with what the requirements are, which does make it harder for manufacturers to deal with; it does make it harder for the industry to deal with. But I think that’s the way this is going to happen.”

In the absence of federal oversight, he added, the states have become “pretty comfortable” establishing their own sets of hemp testing regulations. The future challenge, Craig believes, will be with enforcement.

“Because you have so many different [testing] standards, how do you enforce that?” he asked. “If somebody made a product in Oklahoma and sells it in Colorado, how do you know that? How do you know that they were supposed to make it for Colorado standards? How do you trace that back? Enforcement, to me, is kind of a lynch pin that is going to hold this all together; making sure the regulations are enforced and that people are doing the right thing.”

Related Articles:

- Hemp on Capitol Hill: Industry Insiders on What to Expect in 2022 (January 19, 2022)

- Analysis of Recent Trends in Sales of Hemp-Derived THC & CBD (December 1, 2021)

- Traceability and Hemp: What is the State of the Industry and What New Approaches are Being Utilized? (September 8, 2021)

- Monitoring Hemp for THC Levels: A Constant Struggle (July 21, 2021)