Despite reports of difficult experiences last year for some growers, hemp and hemp-derived CBD continues to generate excitement and interest for many would-be cultivators. Overall, the outlook for total U.S. hemp production capacity in 2020 remains uncertain at this point, even leaving out possible coronavirus-related disruption, as state agriculture departments are still working to register growers and their sites. In general, early feedback indicates that new entrants to the market may take the place of those who have exited or scaled back their production. Some larger producers have also reported to our analysts that they plan to expand their cultivation operations this season.

According to Allen Sommerfeld, Senior Communications Officer for the Minnesota Department of Agriculture, his state received 400 applications and issued 324 hemp program licenses by the end of February. “This is in line with last year’s total,” he told Hemp Benchmarks.

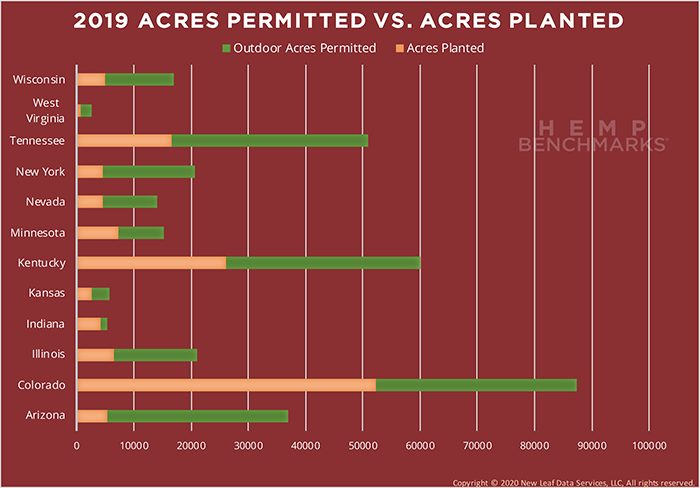

Data collected by the Tennessee Department of Agriculture (TDA), meanwhile, shows the state has 107 growers licensed to grow up to 510 acres for the 2020 season, as of mid-March. “Hemp license applications remain steady,” TDA’s Kim Doddridge said in an email to Hemp Benchmarks. The state is recovering from tornado damage and heavy rains that occurred in March, on top of the COVID-19 pandemic. Those situations may have impacted the plans of some potential farmers and are demanding attention and resources from state officials. While current registered growers and acreage are far below the roughly 4,000 farmers and 51,000 acres licensed in 2019, Doddridge noted that growers have until June 30 to register for licenses and TDA will have a more definitive picture of hemp production capacity in the state after that point.

Elsewhere, there does appear to be a slowdown in the number of people applying for hemp cultivation licenses compared to the 2019 season. Leeann Duwe, Public Information Officer with the Wisconsin Department of Agriculture, Trade, and Consumer Protection, told Hemp Benchmarks that based on data from early March, the total number of applications her state received so far for the 2020 growing season was 1,880, or nearly 350 fewer applications compared to the same time in 2019.

Some industry veterans say a large number of previous hemp growers are wary ahead of the 2020 season. A hemp processor based in the Pacific Northwest told Hemp Benchmarks about a recent conversation he had with a veteran grower in Oregon who is still trying to move several million pounds of hemp biomass from last season. “His words were, ‘Not only am I not going to grow this year, I don’t know anyone who is growing.’” The processor added that some farmers “still have 95% of the biomass they grew last year.”

According to the processor mentioned above, “What I’m seeing are the veterans running [away], and the newbies running into the industry without doing any research. I talk to people all over the country every week, and these people from Texas, Virginia, South Carolina, all over the place … they all want to start a hemp farm.”

An East Coast hemp cultivator and supply chain consultant said that, despite last year’s uneven hemp season, there are some consistencies observers can expect for the 2020 season. “I expect the enthusiasm from the new farmers, just as last year,” he told Hemp Benchmarks. “In respect to the guys who last year was their first year and had a bad experience, and it wasn’t as they thought it was going to be, they’re not doing it again. The seasoned hemp guys, who’ve been through the ups and downs and know the volatility of the market, when to expect the rise and the fall; they’re sticking with it, we’re not going anywhere.”

Given the price volatility for CBD biomass and extracted forms of the cannabinoid, hemp producers are increasingly interested in expanding the current primary market for hemp products into other more historical end markets, such as fiber and grains. While almost all the recent innovation and investment has been directed at extraction and processing equipment for cannabinoids, there are encouraging signs that other end markets may be gaining traction.

Notably, Georgia Pacific, a leading manufacturer of pulp, tissue, paper, and related products, announced a global licensing deal with Bast Fibre Technologies, a Canadian based bast fiber engineering firm that has developed proprietary processes to produce nonwoven fiber from hemp bast, kenaf, and other plant-based fibers. Under the agreement, with the license from Georgia-Pacific, Bast Fibres will develop, process, and market the next generation of sustainable nonwoven fibers to lead in the transition away from synthetic materials toward all-natural, better performing solutions.

The East Coast cultivator cited above also expects to see more hemp grown for grain and fiber in the Eastern U.S. this season. “A lot of the guys who got in [to hemp farming] for CBD got scared off,” he said. “There is infrastructure being put in along the East Coast, where there’s a demand for fiber now.” Pennsylvania, he added, is a large importer of hemp fiber from Europe, and more corporations are seeing the potential of industrial hemp use in applications such as auto interiors and animal bedding. While interest in hemp fiber grows, he said, there still is not a solid supply chain in the region. There may be multiple processing facilities and other infrastructure being planned and capitalized, he said, but they are not yet operational.

For more information on the U.S. hemp fiber market, see our recent post, Hemp Fiber: A Market in Search of a Viable Supply Chain.