With the autumn hemp harvest wrapping up around the country, industry stakeholders are reporting mixed results due to a variety of natural and man-made factors. In the West, extreme drought is taking its toll on hemp and other agriculture. Meanwhile ongoing supply chain disruptions, stemming in large part from the global COVID-19 pandemic, are creating headaches and higher costs for hemp businesses. While this year has been marked by declining hemp product prices and contracting production, continued demand for delta-8 THC has pushed back on those trends to some degree.

How Much Hemp Was Grown in the U.S. This Year?

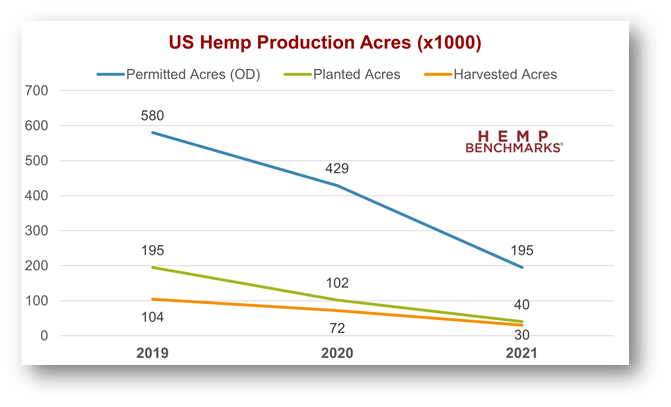

Hemp Benchmarks has documented roughly 195,000 acres registered for hemp cultivation across the country in 2021, down from almost 430,000 in 2020 and about 580,000 acres in 2019.

Based on reports from states and data from the U.S. Department of Agriculture (USDA), Hemp Benchmarks can confirm that at least 40,000 acres were planted this season. The actual figure is likely higher, but still almost certainly represents a significant pullback from the last two years.

In 2020, for example, we documented over 100,000 acres planted with hemp in the U.S. and estimated that the actual figure was as high as 160,000 acres. In 2019 we estimated that about 260,000 acres were planted with cannabinoid hemp, with several thousand more acres devoted to grain and fiber crops.

As we noted in our October Hemp Spot Price Index report, prices for CBD biomass remain depressed and have continued to show downward movement despite the significantly smaller harvest in 2021. In addition to fewer acres of hemp cultivated and harvested this year, reports from major hemp growing regions tell of smaller yields due to drought conditions in the West.

Ongoing Drought Issues

Along the West Coast, up into the Pacific Northwest, and in parts of the Great Plains and Upper Midwest, the ongoing, historic drought continues to affect the hemp industry and other agriculture profoundly. Drought conditions are having “a huge impact on both yield and the quality of the [hemp] flower,” Steve Fuhr, an Oregon-based hemp processor and multi-state industry consultant, told Hemp Benchmarks.

Similar to testimony from Brian Koontz of the Colorado Department of Agriculture, included in last month’s report, Fuhr noted that the extreme water shortage has led to stunted hemp crops. He recently toured a regional hemp farm where the mature plants were only around two feet tall due to insufficient irrigation. Fuhr expects those plants will only yield around two or three ounces of sellable flower per plant.

“This is the second, third, and in some cases fourth year where farmers … just couldn’t get water,” he noted. “The problem is what’s not in the soil, it’s the soil moisture content. I’m starting to notice that the trees are starting to die. It takes three years for trees to show that kind of stress. If this drought continues for another three years we’re going to have a dust bowl.”

A Good Harvest Elsewhere

While parts of the West struggled through this season’s harvest, other parts of the country have reported close to ideal growing conditions. “This season has been one of the best seasons,” said Kevin Shankle, COO of the National Organization of Agriculture and Horticulture (NOAH) in North Carolina. The business – which Shankle described to Hemp Benchmarks as “a seed-to-shelf single source company” with a focus on genetics, cultivation, and processing – has been in existence since 2019.

The company downsized its hemp acreage this year to six acres, compared to 20 acres in 2020. “Last year was very wet,” he said. “We lost about 45% to 55% to bud rot. This year that number is significantly less, I’d say about 10%. This year was a pleasure. I wish we grew the same amount that we grew last year.”

Shankle gave several reasons for his company downsizing its hemp crop this season. Some of the hemp farmers he worked with are no longer in the business. “They were first year [cultivators], and were coming in at one of the worst seasons possible,” he noted. “We also downsized ourselves, due to the massive amount of labor bills we accrued last year.”

COVID-19 and Supply Chain Issues Lead to Rising Costs for Businesses

Global supply chain disruptions, caused in large part by the COVID-19 pandemic, are affecting the day-to-day operations of many hemp businesses. Zach Wilcox, Director of Operations for Fide Freight, a hemp logistics company, told Hemp Benchmarks that shipping costs to move bulk hemp products were on the upswing this month. “And [they] will continue to rise as we get closer to the holidays,” he wrote in an email, due to increased demand for trucks in an already tight market. Detailed hemp transportation cost data can be found in our monthly Hemp Spot Price Index reports.

According to Steve Fuhr, hemp farmers in the Northwest are struggling to find workers to harvest this season’s hemp crop, due in part to COVID, but also other factors. “They’re dealing with competing crops,” he said. Fuhr mentioned a friend with 30 acres of hemp who does not have the money or labor to harvest most of his crop this year. “He got some [flower] tops, some big colas, but the rest is going to sit there,” he noted.

Regulatory changes are also contributing to increased costs for hemp businesses. In October, the U.S. Postal Service (USPS) announced it would no longer deliver vaping and e-cigarette products through the mail. Earlier this year, as we noted in our March and April reports, the Congressional Appropriations Act created strict new rules regarding the delivery of all vaping products, referred to generally as ENDS (electronic nicotine delivery systems), a category that also includes those containing hemp extracts such as CBD and delta-8 THC. At the time, the legislation also prompted a notice from USPS, cautioning that a “forthcoming final rule will determine whether [ENDS] may continue to be mailed.”

On October 21, USPS published the final rule in the Federal Register. It noted that ENDS products are now “generally nonmailable, except as authorized by an exception, and then only if all PACT [Prevent All Cigarette Trafficking]-Act and non-PACT-Act-related conditions of mailability are met.” Among those exceptions are shipments between “verified and authorized” tobacco industry businesses for business-to-business purposes, as well as deliveries to consumers in Alaska and Hawaii. Overall, the USPS’s new final rule will force many businesses dealing in hemp vaping and e-cigarette type products to use more expensive private carriers for shipping.