It is now well-known that the production of industrial hemp for CBD boomed last year in the wake of the 2018 Farm Bill’s federal legalization of the crop and its removal of CBD from the list of controlled substances. In 2019, Hemp Benchmarks estimated that around 90 million pounds of marketable CBD biomass was generated by U.S. farmers.

While this year’s data is still incomplete, information gathered by Hemp Benchmarks, combined with planting data reported to the U.S. Department of Agriculture Farm Service Agency (USDA FSA), begins to bring the scope of this year’s production into focus.

As of October, Hemp Benchmarks has documented roughly 400,000 acres licensed for hemp production nationwide, down about 30% from 2019. Based on information on production targets reported by some state agriculture departments, we estimate that around 80% of licensed acreage was intended for CBD cultivars, or about 320,000 acres. (In 2019, our assumption was that as much as 90% of the country’s licensed acreage was intended for CBD production.)

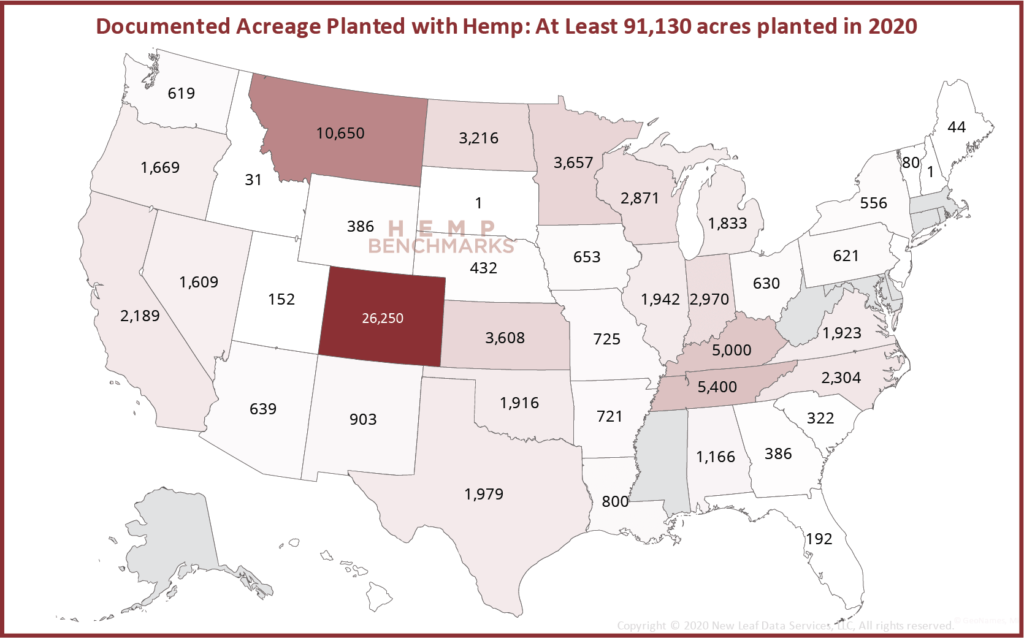

By combining data on planted acreage compiled by Hemp Benchmarks from state agriculture departments and other sources with that reported by farmers to the USDA FSA, we can state that at least 91,000 acres were planted with hemp in 2020. However, this figure is almost certainly an under count, as not all hemp farmers are currently reporting their acreage to the FSA. (Farmers growing other crops typically report their hemp acreage to USDA along with that for their traditional crops, while those growing only hemp are less likely to report.) Also, such data from some states remains absent.

Based on the documented planted acreage, we can assume that anywhere from 25% to 35% of licensed acreage was planted this year. This would translate to between 80,000 and 112,000 acres of hemp planted for CBD production in 2020. In 2019, we were able to gather hard data on about 195,000 acres planted in only 18 states, and estimated that up to 260,000 acres were planted with CBD hemp nationwide.

Finally, if we assume about 50% of planted acreage was harvested successfully and is viable for extraction purposes, with average yields of 1,000 pounds of CBD biomass per acre, our initial estimates for CBD biomass production in 2020 come to between about 40 million and 56 million pounds. These figures are down by 38% – 56% relative to our 2020 production estimate.

Ultimately, we feel it is safe to say that U.S. production of CBD hemp biomass contracted by roughly half from 2019 to 2020. However, as we noted above and have discussed in previous reports, market participants expect that overhang from 2019 combined with this year’s production will result in the persistence of oversupply and depressed prices for CBD biomass.

Overall, the price crash for CBD biomass that occurred in the wake of 2019’s harvest led to a significant decline in production in states with established hemp programs, along with more tentative starts for farmers in states just beginning hemp production this year. Additionally, tighter capital markets and increased uncertainty generated by the COVID-19 pandemic caused many to pull back on previous plans to try their hands at growing hemp.

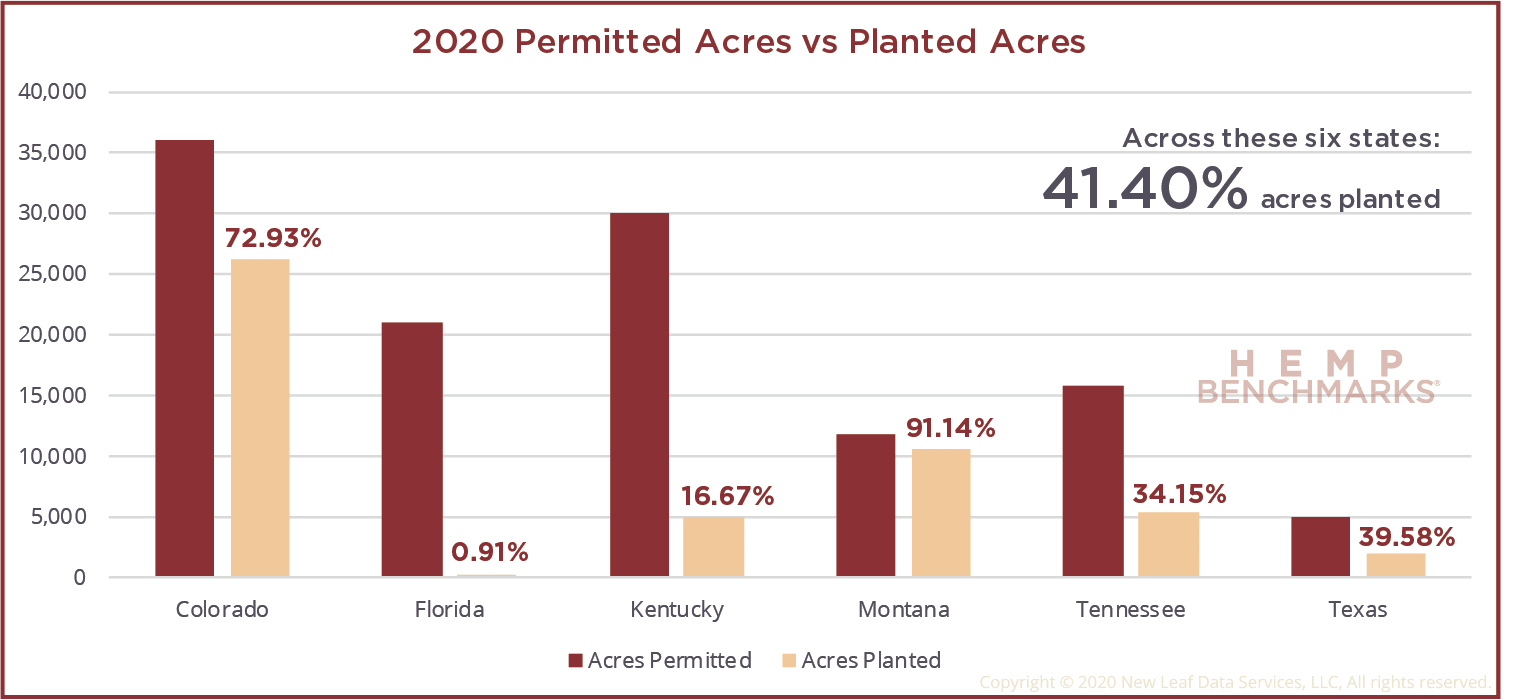

Regarding some selected states with established hemp programs that led the country in planted acreage in 2019: planted acreage in Colorado decreased by about 50% year-over-year in 2020; Tennessee experienced around a 70% decline; Montana saw a roughly 75% downturn (and the acreage planted there this year was almost all for grain; while Kentucky farmers planted about 80% fewer acres this year compared to last.

Meanwhile, in large states like Florida and Texas, which just began permitting hemp production in 2020, reports of initial enthusiasm for hemp amongst farmers gave way to tentativeness. Florida agriculture officials told Hemp Benchmarks that fewer than 200 acres were planted so far this year, while Texas farmers reported under 2,000 acres planted to the USDA FSA. (Planted acreage in Florida should increase going forward, as the state’s climate allows for growing outside the customary spring to fall period that farmers are limited to in most of the Continental U.S.)