Price Commentary

This year’s harvest is beginning to reach market. Despite the new supply, October saw stability in pricing for CBD Biomass. This month’s assessed aggregate price for CBD Biomass was unchanged from September. Smokable Bulk CBD Flower, on the other hand, saw its going rate slide 10% from last month. Smokable flower grown indoors or in greenhouses continues to see premium prices relative to outdoor, but producers are still moving flower grown in 2019, which helped push down the overall assessed price.

CBG Biomass prices dropped even more sharply, with a 36% month-over-month decline observed in October. Additionally, this month saw some reported deals for smokable CBG flower, which ranged from $100 to $800 per pound, while averaging $230 per pound, a 17% premium compared to the assessed price for CBD Flower. While data for such product has been spotty, it appears that the current average price is down significantly from the spring, by about $100 to $150 per pound. Observed transaction volume for CBG flower is low, suggesting that demand is fairly limited for a product with which most consumers are likely unfamiliar.

In addition to the harvest, various market dynamics are impacting prices and deal flow in the realm of hemp-derived cannabinoid products. The price for Crude CBD Oil decreased by 19%, with overall transaction volumes and average deal sizes down somewhat as well. Processors reported a demand slowdown that started around the middle of September and persisted into this month. Consequently, they are waiting to move existing inventory before again ramping up extraction capacity. Similarly, transaction volumes for various types of CBD Distillates were also down this month from peaks observed in mid-late summer.

If prices are any indication, CBG extracts appear to be losing their appeal as their novelty dissipates. CBG Distillate pricing was fairly stable this month, while that for CBG Isolate sank by almost 40%.

October’s going rate for CBD Isolate was also down from September, but sales were strong in terms of the volume of product moved. It has been speculated that increased sales volume of CBD Isolate may be due to expanding production of delta-8 THC, which is manufactured from CBD Isolate. Previously over the course of this year, prices and interest in CBD Isolate were on the decline as product manufacturers showed increasing preference for CBD Distillate, particularly THC Free.

Some transactions for delta-8 THC were again reported this month by our Price Contributor Network. Deals for such product ranged from $1,400 to $3,200 per kilogram, while averaging $2,235 per kilogram. Reported prices for delta-8 THC in October are off by about $300 – $400 per kilogram from two months ago.

[Editor’s Note: The prices quoted above for smokable CBG Flower and delta-8 THC are raw transaction data and do not constitute official Hemp Benchmarks price assessments. Transaction data for such products is currently being vetted to meet Hemp Benchmarks methodology requirements, which include, but are not limited to, several months of statistically significant data and consistent or increasing transaction volume.]

Additional October Report Contents

Price Commentary

CBD Biomass price flat as harvest nears conclusion; Smokable CBD Flower price dips; CBG product prices largely continue to slide.

Harvest Update

Midwest grain hemp farmers report a good season; growers in the Southwest struggled with heat and drought; effect of wildfires on Oregon crop still uncertain.

2020 CBD Biomass Production Estimate

Hemp Benchmarks projects that U.S. production of CBD Biomass will contract by roughly half from 2019 to 2020.

Hemp Transportation Costs Update

Prices to move hemp and hemp products continue to rise; more “project freight” shipments to move large volumes of biomass reported as winter weather begins to disrupt shipping and impact prices.

Federal Regulatory Updates

Funding legislation includes provision to extend 2014 Farm Bill hemp pilot programs, providing some regulatory flexibility for the 2021 growing season.

Industry Updates

Publicly traded CBD company issues rare report of increased sales during coronavirus pandemic.

State Updates

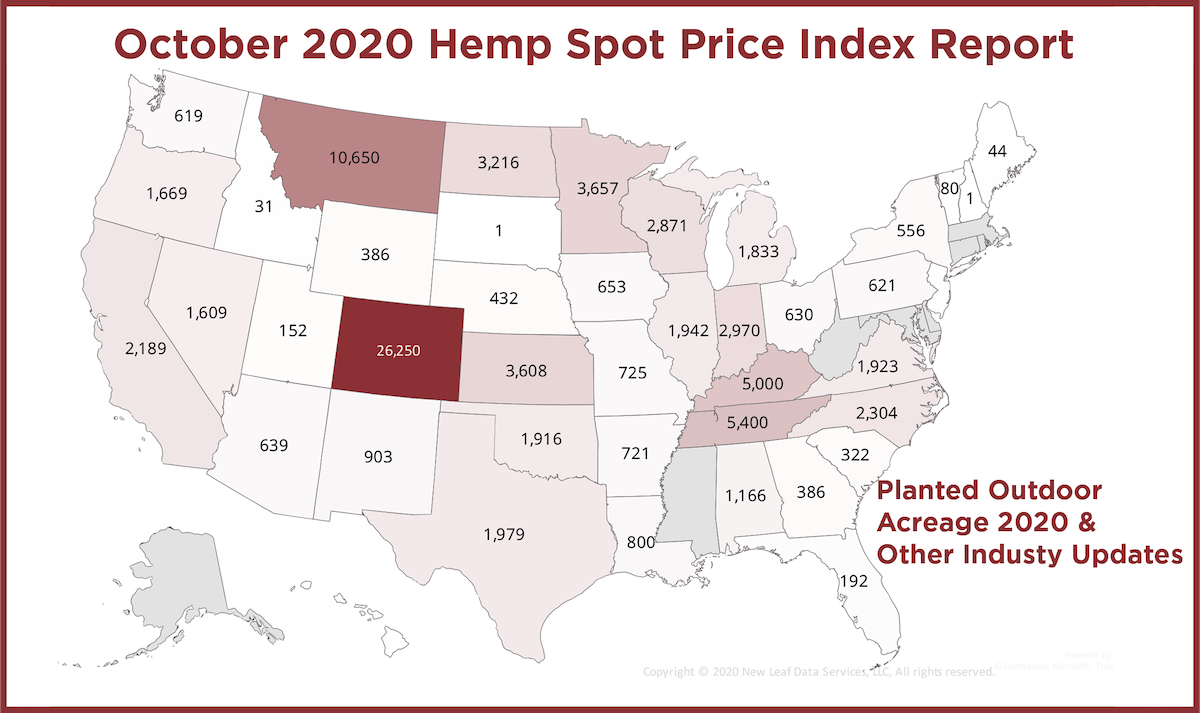

Planted acreage in Colorado down about 50% from prior year; Tennessee’s planted acreage down about 70% from 2019; Florida sees small amounts of hemp planted so far in the first season of growing in the state.

International Updates

Italy classifies CBD as a narcotic, bans non-prescription products in the country; Colorado processor CBD KND Labs opens fulfillment center in London.